But, you may ask, won’t the powers that be step into the breach again and abort the crisis before it gets a chance to run its course? Yes, certainly. That, by now, is standard operating procedure, and it cannot be excluded that it will succeed in the same ambiguous sense that it did after the 1987 stock market crash. If so, we will have the whole process to go through again on a more elevated and more precarious level. But sooner or later, next time or further down the road, it will not succeed… We will then be in a new situation as unprecedented as the conditions from which it will have emerged.

—Harry Magdoff and Paul Sweezy (1988) 1

“The first rule of central banking,” economist James K. Galbraith wrote recently, is that “when the ship starts to sink, central bankers must bail like hell.”2 In response to a financial crisis of a magnitude not seen since the Great Depression, the Federal Reserve and other central banks, backed by their treasury departments, have been “bailing like hell” for more than a year. Beginning in July 2007 when the collapse of two Bear Stearns hedge funds that had speculated heavily in mortgage-backed securities signaled the onset of a major credit crunch, the Federal Reserve Board and the U.S. Treasury Department have pulled out all the stops as finance has imploded. They have flooded the financial sector with hundreds of billions of dollars and have promised to pour in trillions more if necessary—operating on a scale and with an array of tools that is unprecedented.

In an act of high drama, Federal Reserve Board Chairman Ben Bernanke and Secretary of the Treasury Henry Paulson appeared before Congress on the evening of September 18, 2008, during which the stunned lawmakers were told, in the words of Senator Christopher Dodd, “that we’re literally days away from a complete meltdown of our financial system, with all the implications here at home and globally.” This was immediately followed by Paulson’s presentation of an emergency plan for a $700 billion bailout of the financial structure, in which government funds would be used to buy up virtually worthless mortgage-backed securities (referred to as “toxic waste”) held by financial institutions. 3

The outburst of grassroots anger and dissent, following the Treasury secretary’s proposal, led to an unexpected revolt in the U.S. House of Representatives, which voted down the bailout plan. Nevertheless, within a few days Paulson’s original plan (with some additions intended to provide political cover for representatives changing their votes) made its way through Congress. However, once the bailout plan passed financial panic spread globally with stocks plummeting in every part of the world—as traders grasped the seriousness of the crisis. The Federal Reserve responded by literally deluging the economy with money, issuing a statement that it was ready to be the buyer of last resort for the entire commercial paper market (short-term debt issued by corporations), potentially to the tune of $1.3 trillion.

Yet, despite the attempt to pour money into the system to effect the resumption of the most basic operations of credit, the economy found itself in liquidity trap territory, resulting in a hoarding of cash and a cessation of inter-bank loans as too risky for the banks compared to just holding money. A liquidity trap threatens when nominal interest rates fall close to zero. The usual monetary tool of lowering interest rates loses its effectiveness because of the inability to push interest rates below zero. In this situation the economy is beset by a sharp increase in what Keynes called the “propensity to hoard” cash or cash-like assets such as Treasury securities.

Fear for the future given what was happening in the deepening crisis meant that banks and other market participants sought the safety of cash, so whatever the Fed pumped in failed to stimulate lending. The drive to liquidity, partly reflected in purchases of Treasuries, pushed the interest rate on Treasuries down to a fraction of 1 percent, i.e., deeper into liquidity trap territory. 4

Facing what Business Week called a “financial ice age,” as lending ceased, the financial authorities in the United States and Britain, followed by the G-7 powers as a whole, announced that they would buy ownership shares in the major banks, in order to inject capital directly, recapitalizing the banks—a kind of partial nationalization. Meanwhile, they expanded deposit insurance. In the United States the government offered to guarantee $1.5 trillion in new senior debt issued by banks. “All told,” as the New York Times stated on October 15, 2008, only a month after the Lehman Brothers collapse that set off the banking crisis, “the potential cost to the government of the latest bailout package comes to $2.25 trillion, triple the size of the original $700 billion rescue package, which centered on buying distressed assets from banks.”5 But only a few days later the same paper ratcheted up its estimates of the potential costs of the bailouts overall, declaring: “In theory, the funds committed for everything from the bailouts of Fannie Mae and Freddie Mac and those of Wall Street firm Bear Stearns and the insurer American International Group, to the financial rescue package approved by Congress, to providing guarantees to backstop selected financial markets [such as commercial paper] is a very big number indeed: an estimated $5.1 trillion.”6

Despite all of this, the financial implosion has continued to widen and deepen, while sharp contractions in the “real economy” are everywhere to be seen. The major U.S. automakers are experiencing serious economic shortfalls, even after Washington agreed in September 2008 to provide the industry with $25 billion in low interest loans. Single-family home construction has fallen to a twenty-six-year low. Consumption is expected to experience record declines. Jobs are rapidly vanishing. 7 Given the severity of the financial and economic shock, there are now widespread fears among those at the center of corporate power that the financial implosion, even if stabilized enough to permit the orderly unwinding and settlement of the multiple insolvencies, will lead to a deep and lasting stagnation, such as hit Japan in the 1990s, or even a new Great Depression. 8

The financial crisis, as the above suggests, was initially understood as a lack of money or liquidity (the degree to which assets can be traded quickly and readily converted into cash with relatively stable prices). The idea was that this liquidity problem could be solved by pouring more money into financial markets and by lowering interest rates. However, there are a lot of dollars out in the financial world—more now than before—the problem is that those who own the dollars are not willing to lend them to those who may not be able to pay them back, and that’s just about everyone who needs the dollars these days. This then is better seen as a solvency crisis in which the balance sheet capital of the U.S. and UK financial institutions—and many others in their sphere of influence—has been wiped out by the declining value of the loans (and securitized loans) they own, their assets.

As an accounting matter, most major U.S. banks by mid-October were insolvent, resulting in a rash of fire-sale mergers, including JPMorgan Chase’s purchase of Washington Mutual and Bear Stearns, Bank of America’s absorption of Countrywide and Merrill Lynch, and Wells Fargo’s acquiring of Wachovia. All of this is creating a more monopolistic banking sector with government support. 9 The direct injection of government capital into the banks in the form of the purchase of shares, together with bank consolidations, will at most buy the necessary time in which the vast mass of questionable loans can be liquidated in orderly fashion, restoring solvency but at a far lower rate of economic activity—that of a serious recession or depression.

In this worsening crisis, no sooner is one hole patched than a number of others appear. The full extent of the loss in value of securitized mortgage, consumer and corporate debts, and the various instruments that attempted to combine such debts with forms of insurance against their default (such as the “synthetic collateralized debt obligations,” which have credit-debt swaps “packaged in” with the CDOs), is still unknown. Key categories of such financial instruments have been revalued recently down to 10 to 20 percent in the course of the Lehman Brothers bankruptcy and the take-over of Merrill Lynch. 10 As sharp cuts in the value of such assets are applied across the board, the equity base of financial institutions vanishes along with trust in their solvency. Hence, banks are now doing what John Maynard Keynes said they would in such circumstances: hoarding cash. 11 Underlying all of this is the deteriorating economic condition of households at the base of the economy, impaired by decades of frozen real wages and growing consumer debt.

‘It’ and the Lender of Last Resort

To understand the full historical significance of these developments it is necessary to look at what is known as the “lender of last resort” function of the U.S. and other capitalist governments. This has now taken the form of offering liquidity to the financial system in a crisis, followed by directly injecting capital into such institutions and finally, if needed, outright nationalizations. It is this commitment by the state to be the lender of last resort that over the years has ultimately imparted confidence in the system—despite the fact that the financial superstructure of the capitalist economy has far outgrown its base in what economists call the “real” economy of goods and services. Nothing therefore is more frightening to capital than the appearance of the Federal Reserve and other central banks doing everything they can to bail out the system and failing to prevent it from sinking further—something previously viewed as unthinkable. Although the Federal Reserve and the U.S. Treasury have been intervening massively, the full dimensions of the crisis still seem to elude them.

Some have called this a “Minsky moment.” In 1982, economist Hyman Minsky, famous for his financial instability hypothesis, asked the critical question: “Can ‘It’—a Great Depression—happen again?” There were, as he pointed out, no easy answers to this question. For Minsky the key issue was whether a financial meltdown could overwhelm a real economy already in trouble—as in the Great Depression. The inherently unstable financial system had grown in scale over the decades, but so had government and its capacity to serve as a lender of last resort. “The processes which make for financial instability,” Minsky observed, “are an inescapable part of any decentralized capitalist economy—i.e., capitalism is inherently flawed—but financial instability need not lead to a great depression; ‘It’ need not happen” (italics added). 12

Implicit, in this, however, was the view that “It” could still happen again—if only because the possibility of financial explosion and growing instability could conceivably outgrow the government’s capacity to respond—or to respond quickly and decisively enough. Theoretically, the capitalist state, particularly that of the United States, which controls what amounts to a surrogate world currency, has the capacity to avert such a dangerous crisis. The chief worry is a massive “debt-deflation” (a phenomenon explained by economist Irving Fisher during the Great Depression) as exhibited not only by the experience of the 1930s but also Japan in the 1990s. In this situation, as Fisher wrote in 1933, “deflation caused by the debt reacts on the debt. Each dollar of debt still unpaid becomes a bigger dollar, and if the over-indebtedness with which we started was great enough, the liquidation of debt cannot keep up with the fall of prices which it causes.” Put differently, prices fall as debtors sell assets to pay their debts, and as prices fall the remaining debts must be repaid in dollars more valuable than the ones borrowed, causing more defaults, leading to yet lower prices, and thus a deflationary spiral. 13

The economy is still not in this dire situation, but the specter looms.As Paul Asworth, chief U.S. economist at Capital Economics, stated in mid-October 2008, “With the unemployment rate rising rapidly and capital markets in turmoil, pretty much everything points toward deflation. The only thing you can hope is that the prompt action from policy makers can maybe head this off first.” “The rich world’s economies,” the Economist magazine warned in early October, “are already suffering from a mild case of this ‘debt-deflation.’ The combination of falling house prices and credit contraction is forcing debtors to cut spending and sell assets, which in turn pushes house prices and other asset markets down further… A general fall in consumer prices would make matters even worse.”14

The very thought of such events recurring in the U.S. economy today was supposed to be blocked by the lender of last resort function, based on the view that the problem was primarily monetary and could always be solved by monetary means by flooding the economy with liquidity at the least hint of danger. Thus Federal Reserve Board Chairman Ben Bernanke gave a talk in 2002 (as a Federal Reserve governor) significantly entitled “Deflation: Making Sure ‘It’ Doesn’t Happen Here.” In it he contended that there were ample ways of ensuring that “It” would not happen today, despite increasing financial instability:

The U.S. government has a technology, called a printing press (or, today, its electronic equivalent) that allows it to produce as many U.S. dollars as it wishes at essentially no cost. By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.

Of course, the U.S. government is not going to print money and distribute it willy-nilly (although as we will see later, there are practical policies that approximate this behavior). Normally, money is injected into the economy through asset purchases by the Federal Reserve. To stimulate aggregate spending when short-term interest rates have reached zero, the Fed must expand the scale of its asset purchases or, possibly, expand the menu of assets that it buys. Alternatively, the Fed, could find other ways of injecting money into the system—for example, by making low-interest-rate loans to banks or cooperating with fiscal authorities. 15

In the same talk, Bernanke suggested that “a money-financed tax cut,” aimed at avoiding deflation in such circumstances, was “essentially equivalent to Milton Friedman’s famous ‘helicopter drop’ of money”—a stance that earned him the nickname “Helicopter Ben.”16

An academic economist, who made his reputation through studies of the Great Depression, Bernanke was a product of the view propounded most influentially by Milton Friedman and Anna Schwartz in their famous work, A Monetary History of the United States, 1867-1960, that the source of the Great Depression was monetary and could have been combated almost exclusively in monetary terms. The failure to open the monetary floodgates at the outset, according to Friedman and Schwartz, was the principal reason that the economic downturn was so severe. 17 Bernanke strongly opposed earlier conceptions of the Depression that saw it as based in the structural weaknesses of the “real” economy and the underlying accumulation process. Speaking on the seventy-fifth anniversary of the 1929 stock market crash, he stated:

During the Depression itself, and in several decades following, most economists argued that monetary factors were not an important cause of the Depression. For example, many observers pointed to the fact that nominal interest rates were close to zero during much of the Depression, concluding that monetary policy had been about as easy as possible yet had produced no tangible benefit to the economy. The attempt to use monetary policy to extricate an economy from a deep depression was often compared to “pushing on a string.”

During the first decades after the Depression, most economists looked to developments on the real side of the economy for explanations, rather than to monetary factors. Some argued, for example, that overinvestment and overbuilding had taken place during the ebullient 1920s, leading to a crash when the returns on those investments proved to be less than expected. Another once-popular theory was that a chronic problem of “under-consumption”—the inability of households to purchase enough goods and services to utilize the economy’s productive capacity—had precipitated the slump. 18

Bernanke’s answer to all of this was strongly to reassert that monetary factors virtually alone precipitated (and explained) the Great Depression, and were the key, indeed almost the sole, means of fighting debt-deflation. The trends in the real economy, such as the emergence of excess capacity in industry, need hardly be addressed at all. At most it was a deflationary threat to be countered by reflation. 19 Nor, as he argued elsewhere, was it necessary to explore Minsky’s contention that the financial system of the capitalist economy was inherently unstable, since this analysis depended on the economic irrationality associated with speculative manias, and thus departed from the formal “rational economic behavior” model of neoclassical economics. 20 Bernanke concluded a talk commemorating Friedman’s ninetieth birthday in 2002 with the words: “I would like to say to Milton and Anna: Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again.”21 “It” of course was the Great Depression.

Following the 2000 stock market crash a debate arose in central bank circles about whether “preemptive attacks” should be made against future asset bubbles to prevent such economic catastrophes. Bernanke, representing the reigning economic orthodoxy, led the way in arguing that this should not be attempted, since it was difficult to know whether a bubble was actually a bubble (that is, whether financial expansion was justified by economic fundamentals or new business models or not). In addition, to prick a bubble was to invite disaster, as in the attempts by the Federal Reserve Board to do this in the late 1920s, leading (according to the monetarist interpretation) to the bank failures and the Great Depression. He concluded: “monetary policy cannot be directed finely enough to guide asset prices without risking severe collateral damage to the economy… Although eliminating volatility from the economy and the financial markets will never be possible, we should be able to moderate it without sacrificing the enormous strengths of our free-market system.” In short, Bernanke argued, no doubt with some justification given the nature of the system, that the best the Federal Reserve Board could do in face of a major bubble was to restrict itself primarily to its lender of last resort function. 22

At the very peak of the housing bubble, Bernankfe, then chairman of Bush’s Council of Economic Advisors, declared with eyes wide shut: “House prices have risen by nearly 25 percent over the past two years. Although speculative activity has increased in some areas, at a national level these price increases largely reflect strong economic fundamentals, including robust growth in jobs and incomes, low mortgage rates, steady rates of household formation, and factors that limit the expansion of housing supply in some areas.”23 Ironically, it was these views that led to the appointment of Bernanke as Federal Reserve Board chairman (replacing Alan Greenspan) in early 2006.

The housing bubble began to deflate in early 2006 at the same time that the Fed was raising interest rates in an attempt to contain inflation. The result was a collapse of the housing sector and mortgage-backed securities. Confronted with a major financial crisis beginning in 2007, Bernanke as Fed chairman put the printing press into full operation, flooding the nation and the world with dollars, and soon found to his dismay that he had been “pushing on a string.” No amount of liquidity infusions were able to overcome the insolvency in which financial institutions were mired. Unable to make good on their current financial claims—were they compelled to do so—banks refused to renew loans as they came due and hoarded available cash rather than lending and leveraging the system back up. The financial crisis soon became so universal that the risks of lending money skyrocketed, given that many previously creditworthy borrowers were now quite possibly on the verge of insolvency. In a liquidity trap, as Keynes taught, running the printing presses simply adds to the hoarding of money but not to new loans and spending.

However, the real root of the financial bust, we shall see, went much deeper: the stagnation of production and investment.

From Financial Explosion to Financial Implosion

Our argument in a nutshell is that both the financial explosion in recent decades and the financial implosion now taking place are to be explained mainly in reference to stagnation tendencies within the underlying economy. A number of other explanations for the current crisis (most of them focusing on the proximate causes) have been given by economists and media pundits. These include the lessening of regulations on the financial system; the very low interest rates introduced by the Fed to counter the effects of the 2000 crash of the “New Economy” stock bubble, leading to the housing bubble; and the selling of large amounts of “sub-prime” mortgages to many people that could not afford to purchase a house and/or did not fully understand the terms of the mortgages.

Much attention has rightly been paid to the techniques whereby mortgages were packaged together and then “sliced and diced” and sold to institutional investors around the world. Outright fraud may also have been involved in some of the financial shenanigans. The falling home values following the bursting of the housing bubble and the inability of many sub-prime mortgage holders to continue to make their monthly payments, together with the resulting foreclosures, was certainly the straw that broke the camel’s back, leading to this catastrophic system failure. And few would doubt today that it was all made worse by the deregulation fervor avidly promoted by the financial firms, which left them with fewer defenses when things went wrong.

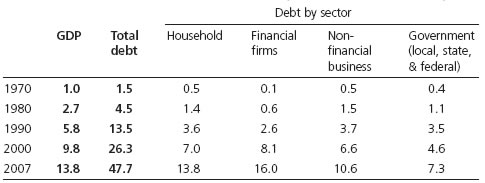

Nevertheless, the root problem went much deeper, and was to be found in a real economy experiencing slower growth, giving rise to financial explosion as capital sought to “leverage” its way out of the problem by expanding debt and gaining speculative profits. The extent to which debt has shot up in relation to GDP over the last four decades can be seen in table 1. As these figures suggest, the most remarkable feature in the development of capitalism during this period has been the ballooning of debt.

Table 1. Domestic debt* and GDP (trillions of dollars)

* The federal part of local, state, and federal debt includes only that portion held by the public. The total debt in 2007 when the federal debt held by federal agencies is added is $51.5 trillion.

Sources: Flow of Funds Accounts of the United States, Table L.1 Credit Market Debt Outstanding, Federal Reserve and Table B-1, Gross domestic product, 1959-2007, Economic Report of the President, 2008.

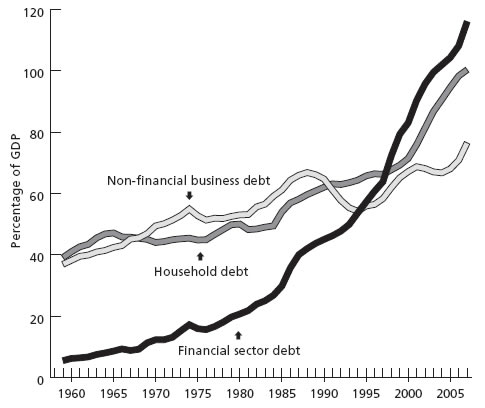

This phenomenon is further illustrated in chart 1 showing the skyrocketing of private debt relative to national income from the 1960s to the present. Financial sector debt as a percentage of GDP first lifted off the ground in the 1960s and 1970s, accelerated beginning in the 1980s, and rocketed up after the mid 1990s. Household debt as a percentage of GDP rose strongly beginning in the 1980s and then increased even faster in the late 1990s. Nonfinancial business debt in relation to national income also climbed over the period, if less spectacularly. The overall effect has been a massive increase in private debt relative to national income. The problem is further compounded if government debt (local, state, and federal) is added in. When all sectors are included, the total debt as a percentage of GDP rose from 151 percent in 1959 to an astronomical 373 percent in 2007!

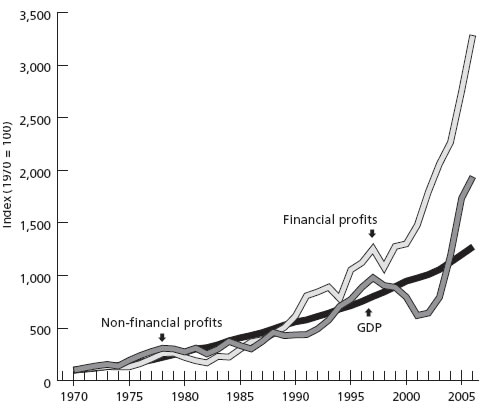

This rise in the cumulative debt load as a percentage of GDP greatly stimulated the economy, particularly in the financial sector, feeding enormous financial profits and marking the growing financialization of capitalism (the shift in gravity from production to finance within the economy as a whole). The profit picture, associated with this accelerating financialization, is shown in chart 2, which provides a time series index (1970 = 100) of U.S. financial versus nonfinancial profits and the GDP. Beginning in 1970, financial and nonfinancial profits tended to increase at the same rate as the GDP. However, in the late 1990s, finance seemed to take on a life of its own with the profits of U.S. financial corporations (and to a lesser extent nonfinancial corporate profits too) heading off into the stratosphere, seemingly unrelated to growth of national income, which was relatively stagnant. Corporations playing in what had become a giant casino took on more and more leveraging—that is, they often bet thirty or more borrowed dollars for every dollar of their own that was used. This helps to explain the extraordinarily high profits they were able to earn as long as their bets were successful. The growth of finance was of course not restricted simply to the United States but was a global phenomenon with speculative claims to wealth far overshadowing global production, and the same essential contradiction cutting across the entire advanced capitalist world and “emerging” economies.

Chart 1. Private debt as percentage of GDP

Sources: Same as table 1.

Chart 2. Growth of financial and nonfinancial profits relative to GDP (1970 = 100)

Sources: Calculated from Table B–91—Corporate profits by industry, 1959–2007. Ta-ble B–1—Gross domestic product, 1959–2007, Economic Report of the President, 2008.

Already by the late 1980s the seriousness of the situation was becoming clear to those not wedded to established ways of thinking. Looking at this condition in 1988 on the anniversary of the 1987 stock market crash, Monthly Review editors Harry Magdoff and Paul Sweezy, contended that sooner or later—no one could predict when or exactly how—a major crisis of the financial system that overpowered the lender of last resort function was likely to occur. This was simply because the whole precarious financial superstructure would have by then grown to such a scale that the means of governmental authorities, though massive, would no longer be sufficient to keep back the avalanche, especially if they failed to act quickly and decisively enough. As they put it, the next time around it was quite possible that the rescue effort would “succeed in the same ambiguous sense that it did after the 1987 stock market crash. If so, we will have the whole process to go through again on a more elevated and precarious level. But sooner or later, next time or further down the road, it will not succeed,” generating a severe crisis of the economy.

As an example of a financial avalanche waiting to happen, they pointed to the “high flying Tokyo stock market,” as a possible prelude to a major financial implosion and a deep stagnation to follow—a reality that was to materialize soon after, resulting in Japan’s financial crisis and “Great Stagnation” of the 1990s. Asset values (both in the stock market and real estate) fell by an amount equivalent to more than two years of GDP. As interest rates zeroed-out and debt-deflation took over, Japan was stuck in a classic liquidity trap with no ready way of restarting an economy already deeply mired in overcapacity in the productive economy. 24

“In today’s world ruled by finance,” Magdoff and Sweezy had written in 1987 in the immediate aftermath of the U.S. stock market crash:

the underlying growth of surplus value falls increasingly short of the rate of accumulation of money capital. In the absence of a base in surplus value, the money capital amassed becomes more and more nominal, indeed fictitious. It comes from the sale and purchase of paper assets, and is based on the assumption that asset values will be continuously inflated. What we have, in other words, is ongoing speculation grounded in the belief that, despite fluctuations in price, asset values will forever go only one way—upward! Against this background, the October [1987] stock market crash assumes a far-reaching significance. By demonstrating the fallacy of an unending upward movement in asset values, it exposes the irrational kernel of today’s economy. 25

These contradictions, associated with speculative bubbles, have of course to some extent been endemic to capitalism throughout its history. However, in the post-Second World War era, as Magdoff and Sweezy, in line with Minsky, argued, the debt overhang became larger and larger, pointing to the growth of a problem that was cumulative and increasingly dangerous. In The End of Prosperity Magdoff and Sweezy wrote: “In the absence of a severe depression during which debts are forcefully wiped out or drastically reduced, government rescue measures to prevent collapse of the financial system merely lay the groundwork for still more layers of debt and additional strains during the next economic advance.” As Minsky put it, “Without a crisis and a debt-deflation process to offset beliefs in the success of speculative ventures, both an upward bias to prices and ever-higher financial layering are induced.”26

To the extent that mainstream economists and business analysts themselves were momentarily drawn to such inconvenient questions, they were quickly cast aside. Although the spectacular growth of finance could not help but create jitters from time to time—for example, Alan Greenspan’s famous reference to “irrational exuberance”—the prevailing assumption, promoted by Greenspan himself, was that the growth of debt and speculation represented a new era of financial market innovation, i.e., a sustainable structural change in the business model associated with revolutionary new risk management techniques. Greenspan was so enamored of the “New Economy” made possible by financialization that he noted in 2004: “Not only have individual financial institutions become less vulnerable to shocks from underlying risk factors, but also the financial system as a whole has become more resilient.”27

It was only with the onset of the financial crisis in 2007 and its persistence into 2008, that we find financial analysts in surprising places openly taking on the contrary view. Thus as Manas Chakravarty, an economic columnist for India’s investor Web site, Livemint.com (partnered with the Wall Street Journal), observed on September 17, 2008, in the context of the Wall Street meltdown,

American economist Paul Sweezy pointed out long ago that stagnation and enormous financial speculation emerged as symbiotic aspects of the same deep-seated, irreversible economic impasse. He said the stagnation of the underlying economy meant that business was increasingly dependent on the growth of finance to preserve and enlarge its money capital and that the financial superstructure of the economy could not expand entirely independently of its base in the underlying productive economy. With remarkable prescience, Sweezy said the bursting of speculative bubbles would, therefore, be a recurring and growing problem. 28

Of course, Paul Baran and Sweezy in Monopoly Capital, and later on Magdoff and Sweezy in Monthly Review, had pointed to other forms of absorption of surplus such as government spending (particularly military spending), the sales effort, the stimulus provided by new innovations, etc. 29 But all of these, although important, had proven insufficient to maintain the economy at anything like full employment, and by the 1970s the system was mired in deepening stagnation (or stagflation). It was financialization—and the growth of debt that it actively promoted—which was to emerge as the quantitatively most important stimulus to demand. But it pointed unavoidably to a day of financial reckoning and cascading defaults.

Indeed, some mainstream analysts, under the pressure of events, were forced to acknowledge by summer 2008 that a massive devaluation of the system might prove inevitable. Jim Reid, the Deutsche Bank’s head of credit research, examining the kind of relationship between financial profits and GDP exhibited in chart 2, issued an analysis called “A Trillion-Dollar Mean Reversion?,” in which he argued that:

U.S. financial profits have deviated from the mean over the past decade on a cumulative basis… The U.S. Financial sector has made around 1.2 Trillion ($1,200bn) of ‘excess’ profits in the last decade relative to nominal GDP… So mean reversion [the theory that returns in financial markets over time “revert” to a long-term mean projection, or trend-line] would suggest that $1.2 trillion of profits need to be wiped out before the U.S. financial sector can be cleansed of the excesses of the last decade… Given that...Bloomberg reports that $184bn has been written down by U.S. financials so far in this crisis, if one believes that the size of the financial sector should shrink to levels seen a decade ago then one could come to the conclusion that there is another trillion dollars of value destruction to go in the sector before we’re back to the long-run trend in financial profits. A scary thought and one that if correct will lead to a long period of constant intervention by the authorities in an attempt to arrest this potential destruction. Finding the appropriate size of the financial sector in the “new world” will be key to how much profit destruction there needs to be in the sector going forward.

The idea of a mean reversion of financial profits to their long-term trend-line in the economy as a whole was merely meant to be suggestive of the extent of the impending change, since Reid accepted the possibility that structural “real world” reasons exist to explain the relative weight of finance—though none he was yet ready to accept. As he acknowledged, “calculating the ‘natural’ appropriate size for the financial sector relative to the rest of the economy is a phenomenally difficult conundrum.” Indeed, it was to be doubted that a “natural” level actually existed. But the point that a massive “profit destruction” was likely to occur before the system could get going again and that this explained the “long period of constant intervention by the authorities in an attempt to arrest this potential destruction,” highlighted the fact that the crisis was far more severe than then widely supposed—something that became apparent soon after. 30

What such thinking suggested, in line with what Magdoff and Sweezy had argued in the closing decades of the twentieth century, was that the autonomy of finance from the underlying economy, associated with the financialization process, was more relative than absolute, and that ultimately a major economic downturn—more than the mere bursting of one bubble and the inflating of another—was necessary. This was likely to be more devastating the longer the system put it off. In the meantime, as Magdoff and Sweezy had pointed out, financialization might go on for quite a while. And indeed there was no other answer for the system.

Back to the Real Economy: The Stagnation Problem

Paul Baran, Paul Sweezy, and Harry Magdoff argued indefatigably from the 1960s to the 1990s (most notably in Monopoly Capital) that stagnation was the normal state of the monopoly-capitalist economy, barring special historical factors. The prosperity that characterized the economy in the 1950s and ’60s, they insisted, was attributable to such temporary historical factors as: (1) the buildup of consumer savings during the war; (2) a second great wave of automobilization in the United States (including the expansion of the glass, steel, and rubber industries, the construction of the interstate highway system, and the development of suburbia); (3) the rebuilding of the European and the Japanese economies devastated by the war; (4) the Cold War arms race (and two regional wars in Asia); (5) the growth of the sales effort marked by the rise of Madison Avenue; (6) the expansion of FIRE (finance, insurance, and real estate); and (7) the preeminence of the dollar as the hegemonic currency. Once the extraordinary stimulus from these factors waned, the economy began to subside back into stagnation: slow growth and rising excess capacity and unemployment/underemployment. In the end, it was military spending and the explosion of debt and speculation that constituted the main stimuli keeping the economy out of the doldrums. These were not sufficient, however, to prevent the reappearance of stagnation tendencies altogether, and the problem got worse with time. 31

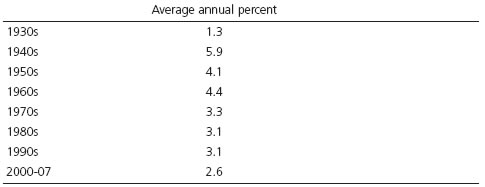

The reality of creeping stagnation can be seen in table 2, which shows the real growth rates of the economy decade by decade over the last eight decades. The low growth rate in the 1930s reflected the deep stagnation of the Great Depression. This was followed by the extraordinary rise of the U.S. economy in the 1940s under the impact of the Second World War. During the years 1950–69, now often referred to as an economic “Golden Age,” the economy, propelled by the set of special historical factors referred to above, was able to achieve strong economic growth in a “peacetime” economy. This, however, proved to be all too temporary. The sharp drop off in growth rates in the 1970s and thereafter points to a persistent tendency toward slower expansion in the economy, as the main forces pushing up growth rates in the 1950s and ’60s waned, preventing the economy from returning to its former prosperity. In subsequent decades, rather than recovering its former trend-rate of growth, the economy slowly subsided.

Table 2. Growth in real GDP 1930–2007

Source: National Income and Products Accounts Table 1.1.1. Percent Change from Preceding Period in Real Gross Domestic Product, Bureau of Economic Analysis.

It was the reality of economic stagnation beginning in the 1970s, as heterodox economists Riccardo Bellofiore and Joseph Halevi have recently emphasized, that led to the emergence of “the new financialized capitalist regime,” a kind of “paradoxical financial Keynesianism” whereby demand in the economy was stimulated primarily “thanks to asset-bubbles.” Moreover, it was the leading role of the United States in generating such bubbles—despite (and also because of) the weakening of capital accumulation proper—together with the dollar’s reserve currency status, that made U.S. monopoly-finance capital the “catalyst of world effective demand,” beginning in the 1980s. 32 But such a financialized growth pattern was unable to produce rapid economic advance for any length of time, and was unsustainable, leading to bigger bubbles that periodically burst, bringing stagnation more and more to the surface.

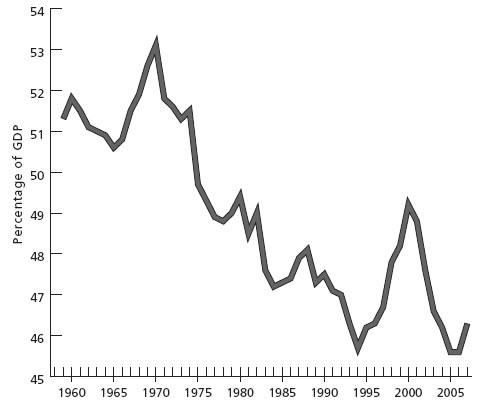

A key element in explaining this whole dynamic is to be found in the falling ratio of wages and salaries as a percentage of national income in the United States. Stagnation in the 1970s led capital to launch an accelerated class war against workers to raise profits by pushing labor costs down. The result was decades of increasing inequality. 33 Chart 3 shows a sharp decline in the share of wages and salaries in GDP between the late 1960s and the present. This reflected the fact that real wages of private nonagricultural workers in the United States (in 1982 dollars) peaked in 1972 at $8.99 per hour, and by 2006 had fallen to $8.24 (equivalent to the real hourly wage rate in 1967), despite the enormous growth in productivity and profits over the past few decades. 34

Chart 3. Wage and salary disbursements as a percent-age of GDP

Sources: Economic Report of the President, 2008, Table B-1 (GDP), Table B–29—Sources of personal income, 1959–2007.

This was part of a massive redistribution of income and wealth to the top. Over the years 1950 to 1970, for each additional dollar made by those in the bottom 90 percent of income earners, those in the top 0.01 percent received an additional $162. In contrast, from 1990 to 2002, for each added dollar made by those in the bottom 90 percent, those in the uppermost 0.01 percent (today around 14,000 households) made an additional $18,000. In the United States the top 1 percent of wealth holders in 2001 together owned more than twice as much as the bottom 80 percent of the population. If this were measured simply in terms of financial wealth, i.e., excluding equity in owner-occupied housing, the top 1 percent owned more than four times the bottom 80 percent. Between 1983 and 2001, the top 1 percent grabbed 28 percent of the rise in national income, 33 percent of the total gain in net worth, and 52 percent of the overall growth in financial worth. 35

The truly remarkable fact under these circumstances was that household consumption continued to rise from a little over 60 percent of GDP in the early 1960s to around 70 percent in 2007. This was only possible because of more two-earner households (as women entered the labor force in greater numbers), people working longer hours and filling multiple jobs, and a constant ratcheting up of consumer debt. Household debt was spurred, particularly in the later stages of the housing bubble, by a dramatic rise in housing prices, allowing consumers to borrow more against their increased equity (the so-called housing “wealth effect”)—a process that came to a sudden end when the bubble popped, and housing prices started to fall. As chart 1 shows, household debt increased from about 40 percent of GDP in 1960 to 100 percent of GDP in 2007, with an especially sharp increase starting in the late 1990s. 36

This growth of consumption, based in the expansion of household debt, was to prove to be the Achilles heel of the economy. The housing bubble was based on a sharp increase in household mortgage-based debt, while real wages had been essentially frozen for decades. The resulting defaults among marginal new owners led to a fall in house prices. This led to an ever increasing number of owners owing more on their houses than they were worth, creating more defaults and a further fall in house prices. Banks seeking to bolster their balance sheets began to hold back on new extensions of credit card debt. Consumption fell, jobs were lost, capital spending was put off, and a downward spiral of unknown duration began.

During the last thirty or so years the economic surplus controlled by corporations, and in the hands of institutional investors, such as insurance companies and pension funds, has poured in an ever increasing flow into an exotic array of financial instruments. Little of the vast economic surplus was used to expand investment, which remained in a state of simple reproduction, geared to mere replacement (albeit with new, enhanced technology), as opposed to expanded reproduction. With corporations unable to find the demand for their output—a reality reflected in the long-run decline of capacity utilization in industry (see chart 4)—and therefore confronted with a dearth of profitable investment opportunities, the process of net capital formation became more and more problematic.

Chart 4. Percent utilization of industrial capacity

Source: Economic Report of the President, 2008, Table B–54—Capacity utilization rates, 1959–2007.

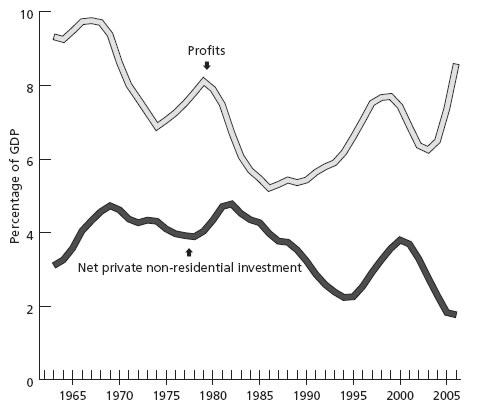

Hence, profits were increasingly directed away from investment in the expansion of productive capacity and toward financial speculation, while the financial sector seemed to generate unlimited types of financial products designed to make use of this money capital. (The same phenomenon existed globally, causing Bernanke to refer in 2005 to a “global savings glut,” with enormous amounts of investment-seeking capital circling the world and increasingly drawn to the United States because of its leading role in financialization.)37 The consequences of this can be seen in chart 5, showing the dramatic decoupling of profits from net investment as percentages of GDP in recent years, with net private nonresidential fixed investment as a share of national income falling significantly over the period, even while profits as a share of GDP approached a level not seen since the late 1960s/early 1970s. This marked, in Marx’s terms, a shift from the “general formula for capital” M(oney)-C(commodity)–M¢ (original money plus surplus value), in which commodities were central to the production of profits—to a system increasingly geared to the circuit of money capital alone, M–M¢, in which money simply begets more money with no relation to production.

Chart 5. Profits and net investment as percentage of GDP 1960 to present

Sources: Bureau of Economic Analysis, National Income and Product Accounts, Table 5.2.5. Gross and Net Domestic Investment by Major Type, (Billions of dollars). Table B-1 (GDP) and Table B-91 (Domestic industry profits), Economic Report of the President, 2008.

Since financialization can be viewed as the response of capital to the stagnation tendency in the real economy, a crisis of financialization inevitably means a resurfacing of the underlying stagnation endemic to the advanced capitalist economy. The deleveraging of the enormous debt built up during recent decades is now contributing to a deep crisis. Moreover, with financialization arrested there is no other visible way out for monopoly-finance capital. The prognosis then is that the economy, even after the immediate devaluation crisis is stabilized, will at best be characterized for some time by minimal growth, and by high unemployment, underemployment, and excess capacity.

The fact that U.S. consumption (facilitated by the enormous U.S. current account deficit) has provided crucial effective demand for the production of other countries means that the slowdown in the United States is already having disastrous effects abroad, with financial liquidation now in high gear globally. “Emerging” and underdeveloped economies are caught in a bewildering set of problems. This includes falling exports, declining commodity prices, and the repercussions of high levels of financialization on top of an unstable and highly exploitative economic base—while being subjected to renewed imperial pressures from the center states.

The center states are themselves in trouble. Iceland, which has been compared to the canary in the coal mine, has experienced a complete financial meltdown, requiring rescue from outside, and possibly a massive raiding of the pension funds of the citizenry. For more than seventeen years Iceland has had a right-wing government led by the ultra-conservative Independence Party in coalition with the centrist social democratic parties. Under this leadership Iceland adopted neoliberal financialization and speculation to the hilt and saw an excessive growth of its banking and finance sectors with total assets of its banks growing from 96 percent of its GDP at the end of 2000 to nine times its GDP in 2006. Now Icelandic taxpayers, who were not responsible for these actions, are being asked to carry the burden of the overseas speculative debts of their banks, resulting in a drastic decline in the standard of living. 38

A Political Economy

Economics in its classical stage, which encompassed the work of both possessive-individualists, like Adam Smith, David Ricardo, Thomas Malthus, and John Stuart Mill, and socialist thinkers such as Karl Marx, was called political economy. The name was significant because it pointed to the class basis of the economy and the role of the state. 39 To be sure, Adam Smith introduced the notion of the “invisible hand” of the market in replacing the former visible hand of the monarch. But, the political-class context of economics was nevertheless omnipresent for Smith and all the other classical economists. In the 1820s, as Marx observed, there were “splendid tournaments” between political economists representing different classes (and class fractions) of society.

However, from the 1830s and ’40s on, as the working class arose as a force in society, and as the industrial bourgeoisie gained firm control of the state, displacing landed interests (most notably with the repeal of the Corn Laws), economics shifted from its previous questioning form to the “bad conscience and evil intent of the apologetics.”40 Increasingly the circular flow of economic life was reconceptualized as a process involving only individuals, consuming, producing, and profiting on the margin. The concept of class thus disappeared in economics, but was embraced by the rising field of sociology (in ways increasingly abstracted from fundamental economic relationships). The state also was said to have nothing directly to do with economics and was taken up by the new field of political science. 41 Economics was thus “purified” of all class and political elements, and increasingly presented as a “neutral” science, addressing universal/transhistorical principles of capital and market relations.

Having lost any meaningful roots in society, orthodox neoclassical economics, which presented itself as a single paradigm, became a discipline dominated by largely meaningless abstractions, mechanical models, formal methodologies, and mathematical language, divorced from historical developments. It was anything but a science of the real world; rather its chief importance lay in its role as a self-confirming ideology. Meanwhile, actual business proceeded along its own lines largely oblivious (sometimes intentionally so) of orthodox economic theories. The failure of received economics to learn the lessons of the Great Depression, i.e., the inherent flaws of a system of class-based accumulation in its monopoly stage, included a tendency to ignore the fact that the real problem lay in the real economy, rather than in the monetary-financial economy.

Today nothing looks more myopic than Bernanke’s quick dismissal of traditional theories of the Great Depression that traced the underlying causes to the buildup of overcapacity and weak demand—inviting a similar dismissal of such factors today. Like his mentor Milton Friedman, Bernanke has stood for the dominant, neoliberal economic view of the last few decades, with its insistence that by holding back “the rock that starts a landslide” it was possible to prevent a financial avalanche of “major proportions” indefinitely. 42 That the state of the ground above was shifting, and that this was due to real, time-related processes, was of no genuine concern. Ironically, Bernanke, the academic expert on the Great Depression, adopted what had been described by Ethan Harris, chief U.S. economist for Barclays Capital, as a “see no evil, hear no evil, speak no evil” policy with respect to asset bubbles. 43

It is therefore to the contrary view, emphasizing the socioeconomic contradictions of the system, to which it is now necessary to turn. For a time in response to the Great Depression of the 1930s, in the work of John Maynard Keynes, and various other thinkers associated with the Keynesian, institutionalist, and Marxist traditions—the most important of which was the Polish economist Michael Kalecki—there was something of a revival of political-economic perspectives. But following the Second World War Keynesianism was increasingly reabsorbed into the system. This occurred partly through what was called the “neoclassical-Keynesian synthesis”—which, as Joan Robinson, one of Keynes’s younger colleagues claimed, had the effect of bastardizing Keynes—and partly through the closely related growth of military Keynesianism. 44 Eventually, monetarism emerged as the ruling response to the stagflation crisis of the 1970s, along with the rise of other conservative free-market ideologies, such as supply-side theory, rational expectations, and the new classical economics (summed up as neoliberal orthodoxy). Economics lost its explicit political-economic cast, and the world was led back once again to the mythology of self-regulating, self-equilibrating markets free of issues of class and power. Anyone who questioned this, was characterized as political rather than economic, and thus largely excluded from the mainstream economic discussion. 45

Needless to say, economics never ceased to be political; rather the politics that was promoted was so closely intertwined with the system of economic power as to be nearly invisible. Adam Smith’s visible hand of the monarch had been transformed into the invisible hand, not of the market, but of the capitalist class, which was concealed behind the veil of the market and competition. Yet, with every major economic crisis that veil has been partly torn aside and the reality of class power exposed.

Treasury Secretary Paulson’s request to Congress in September 2008, for $700 billion with which to bail out the financial system may constitute a turning point in the popular recognition of, and outrage over, the economic problem, raising for the first time in many years the issue of a political economy. It immediately became apparent to the entire population that the critical question in the financial crisis and in the deep economic stagnation that was emerging was: Who will pay? The answer of the capitalist system, left to its own devices, was the same as always: the costs would be borne disproportionately by those at the bottom. The old game of privatization of profits and socialization of losses would be replayed for the umpteenth time. The population would be called upon to “tighten their belts” to “foot the bill” for the entire system. The capacity of the larger public to see through this deception in the months and years ahead will of course depend on an enormous amount of education by trade union and social movement activists, and the degree to which the empire of capital is stripped naked by the crisis.

There is no doubt that the present growing economic bankruptcy and political outrage have produced a fundamental break in the continuity of the historical process. How should progressive forces approach this crisis? First of all, it is important to discount any attempts to present the serious economic problems that now face us as a kind of “natural disaster.” They have a cause, and it lies in the system itself. And although those at the top of the economy certainly did not welcome the crisis, they nonetheless have been the main beneficiaries of the system, shamelessly enriching themselves at the expense of the rest of the population, and should be held responsible for the main burdens now imposed on society. It is the well-to-do who should foot the bill—not only for reasons of elementary justice, but also because they collectively and their system constitute the reason that things are as bad as they are; and because the best way to help both the economy and those at the bottom is to address the needs of the latter directly. There should be no golden parachutes for the capitalist class paid for at taxpayer expense.

But capitalism takes advantage of social inertia, using its power to rob outright when it can’t simply rely on “normal” exploitation. Without a revolt from below the burden will simply be imposed on those at the bottom. All of this requires a mass social and economic upsurge, such as in the latter half of the 1930s, including the revival of unions and mass social movements of all kinds—using the power for change granted to the people in the Constitution; even going so far as to threaten the current duopoly of the two-party system.

What should such a radical movement from below, if it were to emerge, seek to do under these circumstances? Here we hesitate to say, not because there is any lack of needed actions to take, but because a radicalized political movement determined to sweep away decades of exploitation, waste, and irrationality will, if it surfaces, be like a raging storm, opening whole new vistas for change. Anything we suggest at this point runs the double risk of appearing far too radical now and far too timid later on.

Some liberal economists and commentators argue that, given the present economic crisis, nothing short of a major public works program aimed at promoting employment, a kind of new New Deal, will do. Robert Kuttner has argued in Obama’s Challenge that “an economic recovery will require more like $700 billion a year in new public outlay, or $600 billion counting offsetting cuts in military spending. Why? Because there is no other plausible strategy for both achieving a general economic recovery and restoring balance to the economy.”46 This, however, will be more difficult than it sounds. There are reasons to believe that the dominant economic interests would block an increase in civilian government spending on such a scale, even in a crisis, as interfering with the private market. The truth is that civilian government purchases were at 13.3 percent of GNP in 1939—what Baran and Sweezy in 1966 theorized as approximating their “outer limits”—and they have barely budged since then, with civilian government consumption and investment expenditures from 1960 to the present averaging 13.7 percent of GNP (13.8 percent of GDP). 47 The class forces blocking a major increase in nondefense governmental spending even in a severe stagnation should therefore not be underestimated. Any major advances in this direction will require a massive class struggle.

Still, there can be no doubt that change should be directed first and foremost to meeting the basic needs of people for food, housing, employment, health, education, a sustainable environment, etc. Will the government assume the responsibility for providing useful work to all those who desire and need it? Will housing be made available (free from crushing mortgages) to everyone, extending as well to the homeless and the poorly housed? Will a single-payer national health system be introduced to cover the needs of the entire population, replacing the worst and most expensive health care system in the advanced capitalist world? Will military spending be cut back drastically, dispensing with global imperial domination? Will the rich be heavily taxed and income and wealth be redistributed? Will the environment, both global and local, be protected? Will the right to organize be made a reality?

If such elementary prerequisites of any decent future look impossible under the present system, then the people should take it into their own hands to create a new society that will deliver these genuine goods. Above all it is necessary “to insist that morality and economics alike support the intuitive sense of the masses that society’s human and natural resources can and should be used for all the people and not for a privileged minority.”48

In the 1930s Keynes decried the growing dominance of financial capital, which threatened to reduce the real economy to “a bubble on a whirlpool of speculation,” and recommended the “euthanasia of the rentier.” However, financialization is so essential to the monopoly-finance capital of today, that such a “euthanasia of the rentier” cannot be achieved—in contravention of Keynes’s dream of a more rational capitalism—without moving beyond the system itself. In this sense we are clearly at a global turning point, where the world will perhaps finally be ready to take the step, as Keynes also envisioned, of repudiating an alienated moral code of “fair is foul and foul is fair”—used to justify the greed and exploitation necessary for the accumulation of capital—turning it inside-out to create a more rational social order. 49 To do this, though, it is necessary for the population to seize control of their political economy, replacing the present system of capitalism with something amounting to a real political and economic democracy; what the present rulers of the world fear and decry most—as “socialism.”50

Notes

- Harry Magdoff and Paul M. Sweezy, The Irreversible Crisis (New York: Monthly Review Press, 1988), 76. Back to Article

- James K. Galbraith, The Predator State (New York: The Free Press, 2008), 48. Back to Article

- “Congressional Leaders Were Stunned by Warnings,” New York Times, September 19, 2008. Back to Article

- Manas Chakravarty and Mobis Philipose, “Liquidity Trap: Fear of Failure,” Livemint.com, October 11, 2008; John Maynard Keynes, The General Theory of Employment, Interest and Money (London: Macmillan, 1973), 174. Back to Article

- “Drama Behind a $250 Billion Banking Deal,” New York Times, October 15, 2008. Back to Article

- “Government’s Leap into Banking Has its Perils,” New York Times, October 18, 2008. Back to Article

- “Single-Family Homes in U.S. Fall to a 26-Year Low,” Bloomberg.net, October 17, 2008; “Economic Fears Reignite Market Slump,” Wall Street Journal, October 16, 2008. Back to Article

- See “Depression of 2008: Are We Heading Back to the 1930s,” London Times, October 5, 2008. On the Japanese stagnation, see Paul Burkett and Martin Hart-Landsberg, “The Economic Crisis In Japan,” Critical Asian Studies 35, no. 3 (2003): 339–72. Back to Article

- “The U.S. is Said to Be Urging New Mergers in Banking,” New York Times, October 21, 2008. Back to Article

- “CDO Cuts Show $1 Trillion Corporate-Debt Bets Toxic,” Bloomberg.net, October 22, 2008. Back to Article

- “Banks are Likely to Hold Tight to Bailout Money,” New York Times, October 17, 2008. Back to Article

- Hyman Minsky, Can “It” Happen Again? (New York: M. E. Sharpe, 1982), vii–xxiv; “Hard Lessons to be Learnt from a Minsky Moment,” Financial Times, September 18, 2008; Riccardo Bellofiore and Joseph Halevi, “A Minsky Moment?: The Subprime Crisis and the New Capitalism,” in C. Gnos and L. P. Rochon, Credit, Money and Macroeconomic Policy: A Post-Keynesian Approach (Cheltenham: Edward Elgar, forthcoming). For Magdoff and Sweezy’s views on Minsky see The End of Prosperity (New York: Monthly Review Press, 1977), 133–36. Back to Article

- Irving Fisher, “The Debt-Deflation Theory of Great Depressions,” Econometrica, no. 4 (October 1933): 344; Paul Krugman, “The Power of De,” New York Times, September 8, 2008. Back to Article

- “Amid Pressing Problems the Threat of Deflation Looms,” Wall Street Journal, October 18, 2008; “A Monetary Malaise,” Economist, October 11–17, 2008, 24. Back to Article

- Ben S. Bernanke, “Deflation: Making Sure ‘It’ Doesn’t Happen Here,” National Economists Club, Washington, D.C., November 21, 2002, http://www.federalreserve.gov. Back to Article

- Ethan S. Harris, Ben Bernanke’s Fed (Boston, Massachusetts: Harvard University Press, 2008), 2, 173; Milton Friedman, The Optimum Quantity of Money and Other Essays (Chicago: Aldine Publishing, 1969), 4–14. Back to Article

- Ben S. Bernanke, Essays on the Great Depression (Princeton: Princeton University Press, 2000), 5; Milton Friedman and Anna Schwartz, A Monetary History of the United States, 1867–1960 (Princeton: Princeton University Press, 1963). For more realistic views of the Great Depression, taking into account the real economy, as well as monetary factors, and viewing it from the standpoint of the stagnation of investment, which above all characterized the Depression see Michael A. Bernstein, The Great Depression (Cambridge: Cambridge University Press, 1987), and Richard B. DuBoff, Accumulation and Power (New York: M.E. Sharpe, 1989), 84–92. On classic theories of the Great Depression see William A. Stoneman, A History of the Economic Analysis of the Great Depression in America (New York: Garland Publishing, 1979). Back to Article

- Ben S. Bernanke, “Money, Gold, and the Great Depression,” H. Parker Willis Lecture in Economic Policy, Washington and Lee University, Lexington, Virginia, March 2, 2004, http://www.federalreserve.gov. Back to Article

- Ben S. Bernanke, “Some Thoughts on Monetary Policy in Japan,” Japan Society of Monetary Economics, Tokyo, May 31, 2003, http://www.federalreserve.gov. Back to Article

- Bernanke, Essays on the Great Depression, 43. Back to Article

- "On Milton Friedman’s Ninetieth Birthday,” Conference to Honor Milton Friedman, University of Chicago, November 8, 2002. Ironically, Anna Schwartz, now 91, indicated in an interview for the Wall Street Journal that the Fed under Bernanke was fighting the last war, failing to perceive that the issue was uncertainty about solvency of the banks, not a question of liquidity as in the lead-up to the Great Depression. “Bernanke is Fighting the Last War: Interview of Anna Schwartz,” Wall Street Journal, October 18, 2008. Back to Article

- Ben S. Bernanke, “Asset Prices and Monetary Policy,” speech to the New York Chapter of the National Association for Business Economics, New York, N.Y., October 15, 2002, http://www.federalreserve.gov; Harris, Ben Bernanke’s Fed, 147–58. Back to Article

- Ben S. Bernanke, “The Economic Outlook,” October 25, 2005; quoted in Robert Shiller, The Subprime Option (Princeton: Princeton University Press, 2008), 40. Back to Article

- Magdoff and Sweezy, The Irreversible Crisis, 76; Burkett and Hart-Landsberg, “The Economic Crisis in Japan,” 347, 354–56, 36–66; Paul Krugman, “Its Baaack: Japan’s Slump and the Return of the Liquidity Trap,” Brookings Papers on Economic Activity, no. 2 (1998), 141–42, 174–78; Michael M. Hutchinson and Frank Westermann, eds., Japan’s Great Stagnation (Cambridge, Massachusetts: MIT Press, 2006). Back to Article

- Magdoff and Sweezy, The Irreversible Crisis, 51. Back to Article

- Magdoff and Sweezy, The End of Prosperity, 136; Hyman Minsky, John Maynard Keynes (New York, Columbia University Press, 1975), 164. Back to Article

- Greenspan quoted, New York Times, October 9, 2008. See also John Bellamy Foster, Harry Magodff, and Robert W. McChesney, “The New Economy: Myth and Reality,” Monthly Review 52, no. 11 (April 2001), 1–15. Back to Article

- Manas Chakravarty, “A Turning Point in the Global Economic System,” Livemint.com, September 17, 2008. Back to Article

- See John Bellamy Foster, Naked Imperialism (New York: Monthly Review Press, 2006), 45–50. Back to Article

- See Paul A. Baran and Paul M. Sweezy, Monopoly Capital (New York: Monthly Review Press, 1966); Harry Magdoff and Paul M. Sweezy, The Dynamics of U.S. Capitalism (New York: Monthly Review Press, 1972), The Deepening Crisis of U.S. Capitalism (New York: Monthly Review Press, 1981), and Stagnation and the Financial Explosion (New York: Monthly Review Press, 1987). Back to Article

- Bellofiore and Halevi, “A Minsky Moment?” Back to Article

- See Michael Yates, Longer Hours, Fewer Jobs (New York: Monthly Review Press, 1994); Michael Perelman, The Confiscation of American Prosperity (New York: Palgrave Macmillan, 2007. Back to Article

- Correspondents of the New York Times, Class Matters (New York: Times Books, 2005), 186; Edward N. Wolff, ed., International Perspectives on Household Wealth (Cheltenham: Edward Elgar, 2006), 112–15. Back to Article

- For a class breakdown of household debt see John Bellamy Foster, “The Household Debt Bubble,” chapter 1 in John Bellamy Foster and Fred Magdoff, The Great Financial Crisis: Causes and Consequences (New York: Monthly Review Press, 2009). Back to Article

- Ben S. Bernanke, “The Global Savings Glut and the U.S. Current Account Deficit,” Sandridge Lecture, Virginia Association of Economics, Richmond Virginia, March 10, 2005, http://www.federalreserve.gov. Back to Article

- Steingrímur J. Stigfússon, “On the Financial Crisis of Iceland,” MRzine.org, October 20, 2008; “Iceland in a Precarious Position,” New York Times, October 8, 2008; “Iceland Scrambles for Cash,” Wall Street Journal, October 6, 2008. Back to Article

- See Edward J. Nell, Growth, Profits and Prosperity (Cambridge: Cambridge University Press, 1980), 19–28. Back to Article

- Karl Marx, Capital, vol. 1 (New York: Vintage, 1976), 96–98. Back to Article

- See Crawford B. Macpherson, Democratic Theory (Oxford: Oxford University Press, 1973), 195–203. Back to Article

- Friedman and Schwartz, A Monetary History of the United States, 419. Back to Article

- Harris, Ben Bernanke’s Fed, 147–58. Back to Article

- See John Bellamy Foster, Hannah Holleman, and Robert W. McChesney, “The U.S. Imperial Triangle and Military Spending,” Monthly Review 60, no. 5 (October 2008): 1–19. Back to Article

- For a discussion of the simultaneous stagnation of the economy and of economics since the 1970s see Perelman, The Confiscation of American Prosperity. See also E. Ray Canterbery, A Brief History of Economics (River Edge, NJ: World Scientific Publishing, 2001), 417–26. Back to Article

- Robert Kuttner, Obama’s Challenge (White River Junction, Vermont: Chelsea Green, 2008), 27. Back to Article

- Baran and Sweezy, Monopoly Capital, 159, 161; Economic Report of the President, 2008, 224, 250. Back to Article

- Harry Magdoff and Paul M. Sweezy, “The Crisis and the Responsibility of the Left,” Monthly Review 39, no. 2 (June 1987): 1–5. Back to Article

- See Keynes, The General Theory of Employment, Interest, and Money, 376, and Essays in Persuasion (New York: Harcourt Brace and Co., 1932), 372; Paul M. Sweezy, “The Triumph of Financial Capital,” Monthly Review 46, no. 2 (June 1994): 1–11; John Bellamy Foster, “The End of Rational Capitalism,” Monthly Review 56, no. 10 (March 2005): 1–13. Back to Article

- In this respect, it is necessary, we believe, to go beyond liberal economics, and to strive for a ruthless critique of everything existing. Even a relatively progressive liberal economist, such as Paul Krugman, recent winner of the Bank of Sweden’s prize for economics in honor of Alfred Nobel, makes it clear that what makes him a mainstream thinker, and hence a member of the club at the top of society, is his strong commitment to capitalism and “free markets” and his disdain of socialism—proudly proclaiming that “just a few years ago...one magazine even devoted a cover story to an attack on me for my pro-capitalist views.” Paul Krugman, The Great Unraveling (New York: W. W. Norton, 2004), xxxvi. In this context, see Harry Magdoff, John Bellamy Foster, and Robert W. McChesney, “A Prizefighter for Capitalism: Paul Krugman vs. the Quebec Protestors,” Monthly Review 53, no. 2 (June 2001): 1–5. Back to Article

Sem comentários:

Enviar um comentário