The unemployment rate fell to 9.7 percent in May, primarily as a result of 411,000 temporary Census jobs. The Census hires pushed total job creation for May to 431,000; however, the addition of 20,000 non-Census jobs is down sharply from the 217,000 reported for April. Excluding the temporary Census hires, the economy has generated 132,000 jobs a month over the last three months, just a bit more than the amount needed to keep pace with the growth of the labor force.

The weakness in job creation spread across sectors. Construction is again shedding jobs, losing 35,000 jobs in May after showing gains the prior two months. Some of this may have been weather related, with increases in March and April reflecting a bounce-back from the bad weather in February. Employment in the sector is likely to stabilize soon.

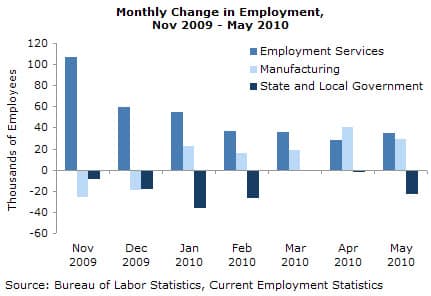

Retail trade lost 6,600 jobs in May after adding 97,000 jobs over the prior four months. Weak sales are the obvious explanation for the job decline. Employment services added 34,400 jobs in May after adding 29,000 in April. The sector had added almost 75,000 a month from October through January.

Health care added just 13,100 jobs in May, down from its average of 20,000 a month over the last year. Restaurants added 5,500 jobs in May compared with an average of 19,000 jobs over the last four months. State and local governments lost 22,000 jobs in May, a pattern that will likely continue with new fiscal years beginning in July.

Manufacturing continues to be a bright spot, adding 29,000 jobs, all of them in the durable sector. Auto manufacturing added 9,300 jobs.

Another bright spot on the establishment side is a 0.1 hour increase in the duration of the average workweek. It is now up by 0.5 hours from its low last October. This is a substantial increase in the demand for labor and could suggest more hiring is imminent. Of course, hours are poorly measured and some of this increase may simply be noise in the data.

Wage growth continues to slow with the average hourly wage rising at a 1.6 percent annual rate over the last quarter, down from a 1.9 percent rate over the last year.

The picture in the household data is very mixed. While the unemployment rate dropped, the employment rate also slipped by 0.1 percent as the labor force was reported as shrinking by 322,000. This likely reflects noise rather than a real decline in the labor force. As noted before, since October, employment growth in the household survey has hugely exceeded jobs growth in the establishment survey. That was likely an aberration that is being reversed.

It appears that African Americans were the biggest gainers in May, with a 1.0 percentage point drop in their unemployment rate overall to 15.5 percent, with the unemployment rate for black women dropping 1.3 percentage points to 12.4 percent.

By education level, college graduates saw a 0.2 percentage point decline in their unemployment rate to 4.7 percent. Unemployment stayed constant for those with some college and rose by 0.3 percentage points for high school grads and those without degrees.

By age group, those over 55 continue to be the big gainers, with employment rising by 111,000 in May. Employment for those over age 55 is up by 760,000 year over year, while it is down by 1,778,000 for everyone else.

The length of unemployment spells continued to increase, no doubt in part because of the unusually long duration of benefits. As noted before, this likely affects the mix of the unemployed, not the number.

Two pieces of good news in the survey were the 388,000 decrease in the number of workers involuntarily working part-time and the continued increase in the percentage of unemployment due to people voluntarily quitting their job. However, the 6.5 percent share is still very low.

This report is a clear warning that the recovery is very weak. The weakness is in spite of the temporary stimulus provided by the hiring of 550,000 Census workers. With house prices falling again, severe state and local budget cutbacks looming, and troubles in Europe dampening exports, the future is not bright.

http://mrzine.monthlyreview.org/2010/baker050610.html

Sem comentários:

Enviar um comentário