John Bellamy Foster, Robert W. McChesney and R. Jamil Jonna

A striking paradox animates political economy in our times. On the one hand, mainstream economics and much of left economics discuss our era as one of intense and increased competition among businesses, now on a global scale. It is a matter so self-evident as no longer to require empirical verification or scholarly examination. On the other hand, wherever one looks, it seems that nearly every industry is concentrated into fewer and fewer hands. Formerly competitive sectors like retail are now the province of enormous monopolistic chains, massive economic fortunes are being assembled into the hands of a few mega-billionaires sitting atop vast empires, and the new firms and industries spawned by the digital revolution have quickly gravitated to monopoly status. In short, monopoly power is ascendant as never before.

This is anything but an academic concern. The economic defense of capitalism is premised on the ubiquity of competitive markets, providing for the rational allocation of scarce resources and justifying the existing distribution of incomes. The political defense of capitalism is that economic power is diffuse and cannot be aggregated in such a manner as to have undue influence over the democratic state. Both of these core claims for capitalism are demolished if monopoly, rather than competition, is the rule.

For all economists, mainstream and left, the assumption of competitive markets being the order of the day also has a striking impact on how growth is assessed in capitalist economies. Under competitive conditions, investment will, as a rule, be greater than under conditions of monopoly, where the dominant firms generally seek to slow down and carefully regulate the expansion of output and investment so as to maintain high prices and profit margins—and have considerable power to do so. Hence, monopoly can be a strong force contributing to economic stagnation, everything else being equal. With the United States and most of the world economy (notwithstanding the economic rise of Asia) stuck in an era of secular stagnation and crisis unlike anything seen since the 1930s—while U.S. corporations are sitting on around $2 trillion in cash—the issue of monopoly power naturally returns to the surface.1

In this review, we assess the state of competition and monopoly in the contemporary capitalist economy—empirically, theoretically, and historically. We explain why understanding competition and monopoly has been such a bedeviling process, by examining the “ambiguity of competition.” In particular, we review how the now dominant neoliberal strand of economics reconciled itself to monopoly and became its mightiest champion, despite its worldview—in theory—being based on a religious devotion to the genius of economically competitive markets.

When we use the term “monopoly,” we do not use it in the very restrictive sense to refer to a market with a single seller. Monopoly in this sense is practically nonexistent. Instead, we employ it as it has often been used in economics to refer to firms with sufficient market power to influence the price, output, and investment of an industry—thus exercising “monopoly power”—and to limit new competitors entering the industry, even if there are high profits.2 These firms generally operate in “oligopolistic” markets, where a handful of firms dominate production and can determine the price for the product. Moreover, even that is insufficient to describe the power of the modern firm. As Paul Sweezy put it, “the typical production unit in modern developed capitalism is a giant corporation,” which, in addition to dominating particular industries, is “a conglomerate (operating in many industries) and multi-national (operating in many countries).”3

In the early 1980s, an unquestioning belief in the ubiquitous influence of competitive markets took hold in economics and in capitalist culture writ large, to an extent that would have been inconceivable only ten years earlier. Concern with monopoly was never dominant in mainstream economics, but it had a distinguished and respected place at the table well into the second half of the twentieth century. For some authors, including Monthly Review editors Sweezy and Harry Magdoff, as well as Paul Baran, the prevalence and importance of monopoly justified calling the system monopoly capitalism. But by the Reagan era, the giant corporation at the apex of the economic system wielding considerable monopoly power over price, output, investment, and employment had simply fallen out of the economic picture, almost as if by fiat. As John Kenneth Galbraith noted in 2004 in The Economics of Innocent Fraud: “The phrase ‘monopoly capitalism,’ once in common use, has been dropped from the academic and political lexicon.”4 For the neoliberal ideologues of today, there is only one issue: state versus market. Economic power (along with inequality) is no longer deemed relevant. Monopoly power, not to mention monopoly capital, is nonexistent or unimportant. Some on the left would in large part agree.

In contrast, we shall demonstrate in what follows that nothing could be further removed from a reality-based social science or economics than the denial of the tendency to monopolization in the capitalist economy: which is demonstrably stronger in the opening decades of the twenty-first century than ever before. More concretely, we argue that what we have been witnessing in the last quarter century is the evolution of monopoly capital into a more generalized and globalized system of monopoly-finance capital that lies at the core of the current economic system in the advanced capitalist economies—a key source of economic instability, and the basis of the current new imperialism.

The Real World Trend: Growth of Monopoly Power

The desirability of monopoly, from the perspective of a capitalist, is self-evident: it lowers risk and increases profits. No sane owner or business wishes more competition; the rational move is always to seek as much monopoly power as possible and carefully avoid the nightmare world of the powerless competitive firm of economics textbooks. Once a firm achieves economic concentration and monopoly power, it is maintained through barriers to entry that make it prohibitively costly and risky for would-be competitors successfully to invade an oligopolistic or monopolistic industry—though such barriers to entry remain relative rather than absolute. Creating and maintaining barriers to entry is essential work for any corporation. In his authoritative study, The Economics of Industrial Organization, William Shepherd provides a list of twenty-two different barriers to entry commonly used by firms to exclude competitors and maintain monopoly power.5

Monopoly, in this sense, is the logical result of competition, and should be expected. It is in the DNA of capitalism. For Karl Marx, capital tended to grow ever larger in a single hand, partly as a result of a straightforward process of concentration of capital (accumulation proper), and even more as a result of the centralization of capital, or the absorption of one capital by another. In this struggle, he wrote, “the larger capitals,” as a rule, “beat the smaller…. Competition rages in direct proportion to the number, and in inverse proportion to the magnitude of the rival capitals. It always ends in the ruin of many small capitalists, whose capitals partly pass into the hands of their competitors, and partly vanish completely. Apart from this, an altogether new force comes into existence with the development of capitalist production: the credit system.” Credit or finance, available more readily to large firms, becomes one of the two main levers, along with competition itself, in the centralization process. By means of mergers and acquisitions, the credit system can create huge, centralized agglomerations of capital in the “twinkling of an eye.” The results of both concentration and centralization are commonly referred to as economic concentration.6

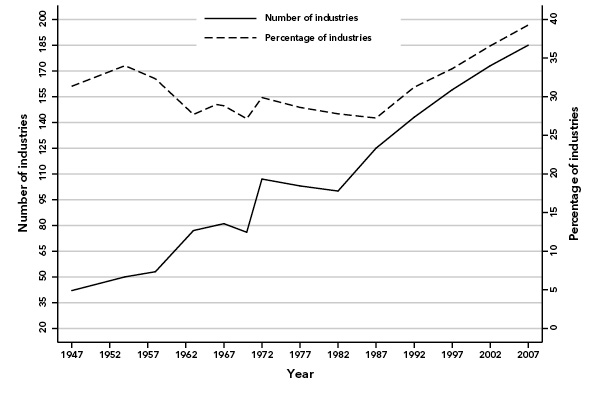

So what do the data tell us about the state of monopoly and competition in the economy today, and the trends since the mid-twentieth century? Chart 1 below shows that both the number and percentage of U.S. manufacturing industries (for example, automobile production) that have a four-firm concentration ratio of 50 percent or more have risen dramatically since the 1980s. More and more industries in the manufacturing sector of the economy are tight oligopolistic or quasi-monopolistic markets characterized by a substantial degree of monopoly. And, if anything, the trend is accelerating.

Chart 1. Number and Percentage of U.S. Manufacturing Industries in which Largest Four Companies Accounted for at Least 50 Percent of Shipment Value in Their Industries, 1947-2002

Notes: The Census Bureau added new industries (i.e., Standard Industrial Classification [SIC] codes) each year since 1947; in that year there were 134; in 1967, 281; and by 1992, 458. Beginning in 1997, the SIC system was replaced by the North American Industrial Classification System (NAICS) and since this time the number of industries leveled off at approximately 472 (in 1997 and 2002, 473; and 2007, 471).

Source: “Shipments Share of 4, 8, 20, & 50 Largest Companies in each SIC: 1992–1947,” Census of Manufactures; and “Economic Census,” 1997, 2002, and 2007, American FactFinder (U.S. Census Bureau, 2011), http://census.gov/epcd/www/concentration.html.

Concentration is also proceeding apace in most other sectors of the economy, aside from manufacturing, such as retail trade, transportation, information, and finance. In 1995 the six largest bank holding companies (JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, Goldman Sachs, and Morgan Stanley—some of which had somewhat different names at that time) had assets equal to 17 percent of U.S. GDP. By the end of 2006, this had risen to 55 percent, and by 2010 (Q3) to 64 percent.7

In retail, the top fifty firms went from 22.4 percent of sales in 1992 to 33.3 percent in 2007. The striking exemplar of retail consolidation has been Wal-Mart, which represents what Joel Magnuson in his Mindful Economics (2008) has called “Monopsony Capitalism.” Wal-Mart uses its power as a “single buyer” (thereby monopsony, as opposed to monopoly or “single seller”) to control production and prices.8 The trends, with respect to concentration in retail, can be seen in Table 1, which shows the rise in four-firm concentration ratios in six key retail sectors and industries, over the fifteen-year period, 1992-2007. Most remarkable was the rise in concentration in general merchandise stores (symbolized by Wal-Mart), which rose from a four-firm concentration ratio of 47.3 in 1992 to 73.2 percent in 2007; and in information goods—with book stores going from a four-firm concentration ratio of 41.3 percent in 1992 to 71 percent in 2007, and computer and software stores from a four-firm concentration ratio of 26.2 percent in 1992 to 73.1 percent in 2007.

Table 1. Percentage of Sales for Four Largest Firms in Selected U.S. Retail Industries

| Industry (NAICS code) | 1992 | 1997 | 2002 | 2007 |

| Food & beverage stores (445) | 15.4 | 18.3 | 28.2 | 27.7 |

| Health & personal care stores (446) | 24.7 | 39.1 | 45.7 | 54.4 |

| General merchandise stores (452) | 47.3 | 55.9 | 65.6 | 73.2 |

| Supermarkets (44511) | 18.0 | 20.8 | 32.5 | 32.0 |

| Book stores (451211) | 41.3 | 54.1 | 65.6 | 71.0 |

| Computer & software stores (443120) | 26.2 | 34.9 | 52.5 | 73.1 |

Notes: The transition to the NAICS system means that 1992 cannot be strictly compared to later years (see Chart 1). However, the above industries were matched using “NAICS Concordances” provided by the U.S. Census Bureau.

Source: “Economic Census,” 1992, 1997, 2002, and 2007, American FactFinder (U.S. Census Bureau, 2011).

Concentration ratios for individual industries are important, but are of more limited value today than in the past in getting at the full range of monopoly power of the giant corporation. This is because the typical giant firm operates not in just one industry, but is a conglomerate, operating in numerous industries. The best way to get an overall picture of the trend toward economic concentration that takes into account the multi-industry nature of the typical giant firm is to look at some measure of aggregate concentration, e.g., the economic status of the two hundred largest firms compared to all firms in the economy.9

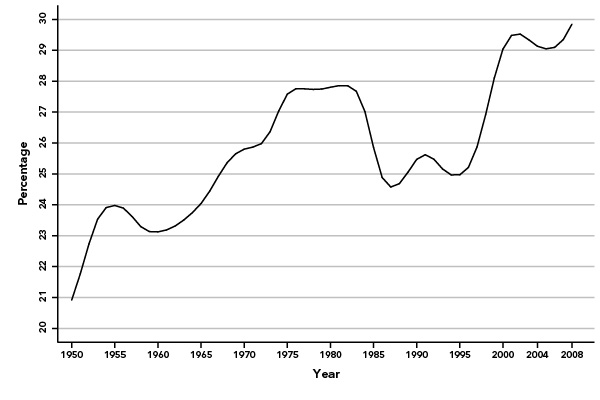

To put the top two hundred firms in perspective, in 2000 there were 5.5 million corporations, 2.0 million partnerships, 17.7 million nonfarm sole proprietorships, and 1.8 million farm sole proprietorships in the U.S. economy.10 Chart 2 shows the revenue of the top two hundred U.S. corporations as a percentage of the total business revenue in the economy since 1950. What we find is that the revenue of the top two hundred corporations has risen substantially from around 21 percent of total business revenue in 1950 to about 30 percent in 2008.11

Chart 2. Revenue of Top 200 U.S. Corporations as Percentage of Total Business Revenue, U.S. Economy, 1950–2008

Notes: “Total revenues” (COMPUSTAT) and “total receipts” (SOI) are equivalent. Since the COMPUSTAT dataset contains only conglomerate-level data all foreign companies—defined as those not incorporated in the United States—were dropped. In this Figure, as well as for Figures 3, 4, and 5, a robust linear smoother was used so the line approximates a five-year moving average. COMPUSTAT data was extracted from Wharton Research Data Services (WRDS). WRDS was used in preparing this article. This service and the data available thereon constitute valuable intellectual property and trade secrets of WRDS and/or its third-party suppliers.

Source: Data for the top 200 corporations (see notes) were extracted from COMPUSTAT, “Fundamentals Annual: North America” (accessed February 15, 2011). Total revenue was taken from “Corporate Income Tax Returns” (line item “total receipts”) Statistics of Income (Washington, DC: Internal Revenue Service, 1950–2008).

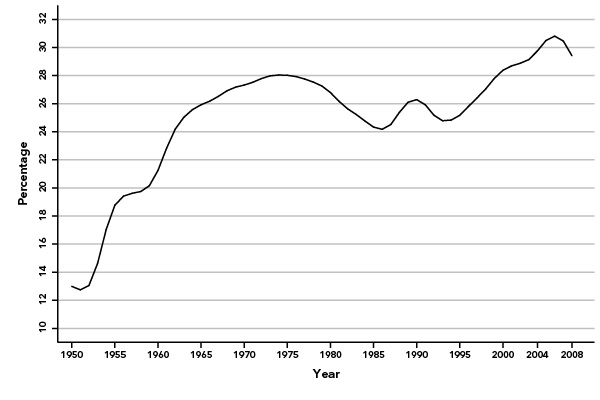

The capacity of the giant firms in the economy to obtain higher profits than their smaller competitors is the main indicator of the degree of monopoly exercised by these megacorporations. Chart 3, above, shows the total gross profits of the top two hundred U.S. corporations as a percentage of total business profits in the U.S. economy, from 1950-2008, during which their share rose from 13 percent in 1950 to over 30 percent in 2007.

Chart 3. Gross Profits of Top 200 U.S. Corporations as Percentage of Total Gross Profits in U.S. Economy, 1950–2008

Notes: Total gross profits were calculated by subtracting “cost of goods sold” (or “cost of sales and operations” for earlier years) from “business receipts.” This follows the definition used in the COMPUSTAT database. Business receipts are defined as gross operating receipts of a firm reduced by the cost of returned goods and services. Generally, they include all corporate receipts except investment and incidental income. Also see notes to Figure 2.

Source: See Figure 2. Total gross profits (see notes for calculations) were taken from “Corporate Income Tax Returns,” Statistics of Income (Washington, DC: Internal Revenue Service, various years).

The share of profits of the top two hundred corporations turned down briefly in 2008, reflecting the Great Financial Crisis, which hit the largest corporations first and then radiated out to the rest of the economy. Although available data ends in 2008, it is clear nonetheless that the largest corporations rebounded in 2009 and 2010, gaining back what they had lost and probably a lot more. Referring to the top five hundred firms, Fortune magazine (April 15, 2010) indicated that their earnings rose 335 percent in 2009, the second largest increase in the fifty-six years of the Fortune 500 data. Returns on sales more than quadrupled in 2009. As Fortune writes: “Hence, the 500’s profits virtually returned to normal after years of extremes—bubbles in 2006 and 2007, collapse in 2008—despite a feeble overall recovery that’s far from normal.” There is little doubt that this recovery of the giant firms was related to their monopoly power, which allowed them to shift the costs of the crisis onto the unemployed, workers, and smaller firms.12

A New Wave of Competition?

The evidence we have provided with respect to the U.S. economy suggests that economic concentration is greater today than it has ever been, and it has increased sharply over the past two decades. Why then is this not commonly acknowledged—and even frequently denied? Why indeed have so many across the political spectrum identified the past third of a century as an era of renewed economic competition? There are several possible explanations for this that deserve attention. For starters, the past three decades have seen dramatic changes in the world economy and much upheaval. Four major trends have occurred that, individually and in combination, have appeared to foster new economic competition, while at the same time leading inexorably to greater concentration: (1) economic stagnation; (2) the growth of the global competition of multinational corporations; (3) financialization; and (4) new technological developments.

The slowdown of the real growth rates of the capitalist economies, beginning in the 1970s, undoubtedly had a considerable effect in altering perceptions of monopoly and competition. Although monopolistic tendencies of corporations were not generally seen in the economic mainstream as a cause of the crisis, the post-Second World War accommodation between big capital and big unions, in manufacturing in particular, was often presented as a key part of the diagnosis of the stagflation crisis of the 1970s. Dominant interests associated with capital insisted that the large firms break loose from the industrial relations moorings they had established. The restructuring of firms to emphasize leaner and meaner forms of competition in line with market pressures was viewed by the powers-that-be as crucial to the revitalization of the economy. The result of all of this, it was widely contended, was the launching of a more competitive global capitalism.

The giant corporations that had arisen in the monopoly stage of capitalism operated increasingly as multinational corporations on the plane of the global economy as a whole—to the point that they confronted each other with greater or lesser success in their own domestic markets as well in the global economy. The result was that the direct competitive pressures experienced by corporate giants went up. Nowhere were the negative effects of this change more evident than in relation to U.S. corporations, which in the early post-Second World War years had benefitted from the unrivaled U.S. hegemony in the world economy. Multinational corporations encouraged worldwide outsourcing and sales as ways of increasing their profit margins, relying less on national markets for their production and profits. Viewed from any given national perspective, this looked like a vast increase in competition—even though, on the international plane as a whole, it encouraged a more generalized concentration and centralization of capital.

The U.S. automobile industry was the most visible manifestation of this process. The Detroit Big Three, the very symbol of concentrated economic power, were visibly weakened in the 1970s with renewed international competition from Japanese and German automakers, which were able to seize a share of the U.S. market itself. As David Harvey has noted: “Even Detroit automakers, who in the 1960s were considered an exemplar of the sort of oligopoly condition characteristic of what Baran and Sweezy defined as ‘monopoly capitalism,’ found themselves seriously challenged by foreign, particularly Japanese, imports. Capitalists have therefore had to find other ways to construct and preserve their much coveted monopoly powers. The two major moves they have made” involve “massive centralization of capital, which seeks dominance through financial power, economies of scale, and market position, and avid protection of technological advantages…through patent rights, licensing laws, and intellectual property rights.”13

One of the most important historical changes affecting the competitive conditions of large industrial corporations was the reemergence of finance as a driver of the system, with power increasingly shifting in this period from corporate boardrooms to financial markets.14 Financial capital, with its movement of money capital at the speed of light, increasingly called the shots, in sharp contrast to the 1950s and ’60s during which industrial capital was largely self-financing and independent of financial capital. In the new age of speculative finance, it was often contended that an advanced and purer form of globalized competition had emerged, governed by what journalist Thomas Friedman dubbed “the electronic herd,” over which no one had any control.15 The old regime of stable corporations was passing and, to the untrained eye, that looked like unending competitive turbulence—a veritable terra incognita.

Technological changes also affected perceptions of the role of the giant corporations. With new technologies associated in particular with the digital revolution and the Internet giving rise to whole new industries and giant firms, many of the old corporate powers, such as IBM, were shaken, though seldom experienced a knockout punch. John Kenneth Galbraith’s world of The New Industrial State, where a relatively small group of corporations ruled imperiously over the market based on their own “planning system,” was clearly impaired.16

All of these developments are commonly seen as engendering greater competition in the economy, and could therefore appear to conflict with a notion of a general trend toward monopolization. However, the reality of the case is more nuanced. Most of these skirmishes were being fought out by increasingly centralized global corporations, each aiming to maintain or advance its relative monopoly power. Such globalized oligopolistic rivalry has more to do, as Harvey says, with constructing and conserving “much-coveted monopoly powers” than promoting competition in the narrow sense in which that term is employed in received economics. Twentieth-century monopoly capitalism was not returning to its earlier nineteenth-century competitive stage, but evolving into a twenty-first-century phase of globalized, financialized monopoly capital. The booming financial sector created turmoil and instability, but it also expedited all sorts of mergers and acquisitions. In the end, finance has been—as it invariably is—a force for monopoly. Announced worldwide merger and acquisition deals in 1999 reached $3.4 trillion, an amount equivalent at that time to 34 percent of the value of all industrial capital (buildings, plants, machinery, and equipment) in the United States.17 In 2007, just prior to the Great Financial Crisis, worldwide mergers and acquisitions reached a record $4.38 trillion, up 21 percent from 2006.18 The long-term result of this process is a ratcheting up of the concentration and centralization of capital on a world scale.

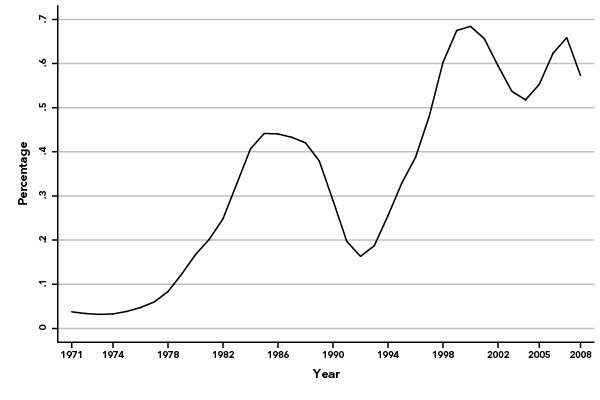

Chart 4 shows net value of acquisitions of the top five hundred global corporations (with operations in the United States and Canada) as a percentage of world income. The upward trend in the graph, most marked since the 1990s, indicates that acquisitions of these giant multinational corporations are centralizing capital at rates in excess of the growth of world income. Indeed, as the chart indicates, there was a tenfold increase in the net value of annual global acquisitions by the top five hundred firms (operating in the United States and Canada) as a percentage of world income from the early 1970s through 2008.

Chart 4. Net Value of Acquisitions of Top 500 Global Corporations (with Operations in United States and Canada) as Percentage of World Income (GDP), 1971–2008

Notes: The COMPUSTAT North America dataset does not technically cover all global corporations, only those required to file in the United States or Canada. Therefore, the value of acquisitions, as well as total revenues (Chart 5), are understated to some degree. In 2009, revenues for the top 500 global corporations operating in the United States totaled $18 trillion; in comparison, Fortune’s “Global 500,” which includes the top corporations operating inside and outside North America, gives a total of $23 trillion (Chart 5 compares the two series on revenues). The COMPUSTAT series is incomparable in terms of its length and consistency of measurement, however, which is why we report it here.

Source: See Chart 2. “World Development Indicators,” World Bank, http://databank.worldbank.org.

To assess all the new competition that the aforementioned four factors ostensibly encouraged and the result to which this leads, let us return to the automobile industry. As the dust cleared after the upheaval of the 1970s and 1980s, there was no longer a series of national automobile industries but rather a global oligopoly for automobile production, where five multinational firms—all of which were national powerhouses at the beginning of the process—produced nearly half the world’s motor vehicles, and the ten largest firms produced 70 percent of the world’s motor vehicles. There is a power law distribution thereafter; the twenty-fifth largest motor vehicle producer now accounts for around one-half of 1 percent of the global market, and the fiftieth largest global producer accounts for less than one-tenth of 1 percent of production.19 The logic of the situation points to another wave of mergers and acquisitions and consolidation among the remaining players. There are no banks lining up to cut $50 billion checks to the fiftieth ranked firm so it can make a play to join the ranks of the big five. There is little to no chance that newcomers will arise out of the blue or from another planet to challenge the dominance of the handful of firms that rule global automobile production.

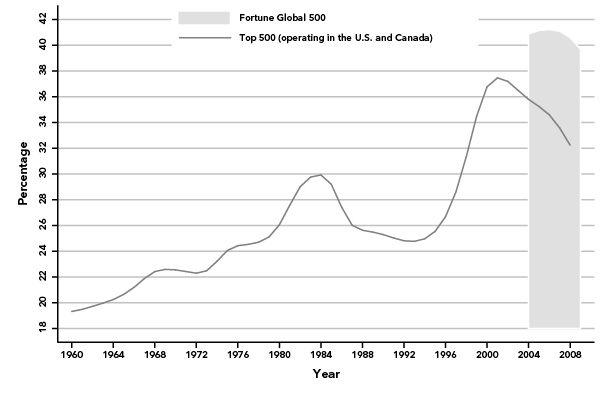

As Chart 5 shows, the share of revenue of the largest five hundred corporations in the world (with operations in the United States and Canada) has been trending upward since the 1950s. In 2006, just prior to the Great Financial Crisis, the world revenues of these firms equaled about 35 percent of world income, and then dipped when the crisis hit. Over the last six years, Fortune has been compiling its own list of the top five hundred corporations in the world known as the “Global 500” (this consists not just of those global corporations operating in the United States and Canada, as in the COMPUSTAT data used in the longer time series, but also the top five hundred operating in the world at large). This shows Global 500 revenues on the order of 40 percent of world GDP (falling to around 39 percent in 2008). The percentages shown by these two series are highly significant. Were the five hundred largest shareholders in a company to own 35-40 percent of the shares of a firm, they would be considered to have the power to control its operations. Although the analogy is not perfect, there can be no doubt that such giant corporate enterprises increasingly represent a controlling interest in the world economy, with enormous consequences for the future of capitalism, the population of the world, and the planet.

Chart 5. Total Revenues of Top 500 Global Corporations as Percentage of World Income (GDP), 1960–2009

Source: See sources and notes to Chart 4. “Fortune Global 500,” Fortune, 2005–2010 (data are for previous fiscal year).

In 2009 the top twenty-five global private megacorporations by revenue rank were: Wal-Mart Stores, Royal Dutch Shell, Exxon Mobil, BP, Toyota Motor, AXA, Chevron, ING Group, General Electric, Total, Bank of America, Volkswagen, ConocoPhillips, BNP Paribus, Assicurazioni Generali, Allianz, AT&T, Carrefour, Ford Motor, ENI, JPMorgan Chase, Hewlett-Packard, E.ON, Berkshire Hathaway, and GDF Suez.20 Such firms straddle the globe. Samir Amin aptly calls this “the late capitalism of generalized, financialized, and globalized oligopolies.” There is no doubt that giant global corporations are able to use their disproportionate power to leverage monopoly rents, imposed on populations, states, and smaller corporations.21 So much for that new wave of competition.

The Ambiguity of Competition

In our view, the best explanation for the continuing confusion about the degree of monopoly in the economy is due to what we call the “ambiguity of competition.” This refers to the opposite ways in which the concept of competition is employed in economics and in more colloquial language, including the language of business itself. It is best explained by Milton Friedman, in his conservative classic Capitalism and Freedom, first published in 1962: “Competition,” Friedman writes,

has two very different meanings. In ordinary discourse, competition means personal rivalry, with one individual seeking to outdo his known competitor. In the economic world, competition means almost the opposite. There is no personal rivalry in the competitive market place. There is no personal higgling. The wheat farmer in a free market does not feel himself in personal rivalry with, or threatened by, his neighbor, who is, in fact, his competitor. No one participant can determine the terms on which other participants shall have access to goods or jobs. All take prices as given by the market and no individual can by himself have more than a negligible influence on price though all participants together determine the price by the combined effect of their separate actions.22

Competition, in other words, exists when, because of the large number and small size of firms, the typical business unit has no significant control over price, output, investment, which are all given by the market—and when each firm stands in a non-rivalrous relation to its competitors. An individual firm is powerless to intervene in ways that change the basic competitive forces it or another firm faces. The fate of each business is thus largely determined by market forces beyond its control. Such assumptions are given a very restrictive and determinate form in neoclassical economic notions of perfect and pure competition, but the general view of competition in this respect is common to all economics. This is the principal meaning of competition in economics.

Yet, as Friedman emphasizes, the above economic definition of competition conflicts directly with the way in which the concept of competition is used more generally and in business analyses to refer to rivalry, particularly between oligopolistic firms. Competition in the business sense of rivalry, he says, is “the opposite” of the meaning of competition in economics associated with the anonymity of one’s competitors.

The same problem arises exactly the other way around with respect to what is taken to be the inverse of competition: monopoly. As Friedman states: “Monopoly exists when a specific individual or enterprise has sufficient control over a particular product or service to determine significantly the terms on which other individuals shall have access to it. In some ways, monopoly comes closer to the ordinary concept of competition since it does involve personal rivalry” (italics added).23 In economic terms, he is telling us, monopoly can be said to exist when firms have “significant” monopoly power, able to affect price, output, investment, and other factors in markets in which they operate, and thus achieve monopolistic returns. Such firms are more likely to be in rivalrous oligopolistic relations with other firms. Hence, monopoly, ironically, “comes closer,” as Friedman stressed, to the “ordinary concept of competition.”

The ambiguity of competition evident in Friedman’s definitions of competition and monopoly illuminates the fact that today’s giant corporations are closer to the monopoly side of the equation. Most of the examples of competition and competitive strategy that dominate economic news are in fact rivalrous struggles between quasi-monopolies (or oligopolies) for greater monopoly power. Hence, to the extent to which we speak of competition today, it is more likely to be oligopolistic rivalry, i.e., battles between monopoly-capitalist firms. Or to underline the irony, the greater the amount of discussion of cutthroat competition in media and business circles and among politicians and pundits, the greater the level of monopoly power in the economy.

What we are calling “the ambiguity of competition” was first raised as an issue in the 1920s by Joseph Schumpeter, who was concerned early on with the effect of the emergence of the giant, monopolistic corporation on his own theory of an economy driven by innovative entrepreneurs. The rise of big business in the developed capitalist economies in the early twentieth century led to a large number of attempts to explain the shift from competitive to what was variously called, trustified, concentrated, or monopoly capitalism. Marxist and radical theorists played the most prominent part in this, building on Marx’s analysis of the concentration and centralization of capital. The two thinkers who were to go the furthest in attempting to construct a distinct theory of monopoly-based capitalism in the early twentieth century were the radical American economist Thorstein Veblen in The Theory of Business Enterprise (1904) and the Austrian Marxist Rudolf Hilferding in his Finance Capital (1910). In his Imperialism, The Highest Stage of Capitalism Lenin depicted imperialism in its “briefest possible definition,” as “the monopoly stage of capitalism.”24 The Sherman Antitrust Act was passed in the United States in 1890 in an attempt to control the rise of cartels and monopolies. No one at the time doubted that capitalism had entered a new phase of economic concentration, for better or for worse.

In 1928 Schumpeter addressed these issues and the threat they represented to the whole theoretical framework of neoclassical economics in an article entitled “The Instability of Capitalism.” “The nineteenth century,” he argued, could be called “the time of competitive, and what has so far followed, the time of increasingly ‘trustified,’ or otherwise ‘organized,’ ‘regulated,’ or ‘managed,’ capitalism.” For Schumpeter, conditions of dual monopoly or “multiple monopoly” (the term “oligopoly” had not yet been introduced) were much “more important practically” than either perfect competition or the assumption of a single monopoly, and of more general importance “in a theoretic sense.” The notion of pure competition was, in fact, “very much in the nature of a crutch” for orthodox economics, and due to overreliance on it, the undermining of economic orthodoxy was “a rather serious one.” Trustified capitalism raised the ambiguity of competition directly: “Such things as bluffing, the use of non-economic force, a will to force the other party to their knees, have much more scope in the case of two-sided monopoly—just as cut-throat methods have in the case of limited competition—than in a state of perfect competition.”

Schumpeter’s own solution to this in “The Instability of Capitalism” (and much later in his 1942 Capitalism, Socialism, and Democracy) was to introduce the concept of “corespective pricing.” This meant that the giant firms in a condition of “multiple monopoly” (or oligopoly) acted as corespectors, determining their actions in relation to those of others, deliberately seeking to restrict their rivalry, particularly in relation to price, by various forms of collusion, in order to maximize group advantage.25 Yet there was no hiding the fact that such a solution constituted a serious “breach” in the wall of economics, introducing a notion of the basic economic unit that was foreign to the entire corpus of received economics in both its classical and neoclassical phases.26

This breach in the established doctrine was only to widen in subsequent decades. In mainstream economics the theory of imperfect competition introduced almost simultaneously by Joan Robinson and Edward Chamberlain in the 1930s, dealt not only (or even mainly) with oligopoly but rather emphasized the influence of monopolistic factors of all kinds in firms at every level, particularly in the form of product differentiation.27 It was found that monopoly elements were much more pervasive in the economy than the orthodox neoclassical analysis of perfect competition allowed. Sweezy developed the most influential theory of oligopolistic pricing, known as the “kinked-demand curve” analysis in 1939. He argued that there was a “kink” in the demand curve at the existing price such that oligopolistic firms would find themselves facing competitive price warfare, and hence would experience no gain in market share if they sought to lower prices, which would then only squeeze profits.28 These contributions to imperfect competition theory constituted an important qualification to conventional economics. Yet they were largely excluded from the core analytical framework of orthodox economics, which continued to rest on the unrealistic and increasingly preposterous assumptions of perfect competition, with its infinitely large numbers of buyers and sellers. Hence, small firms, able to enter and exit freely from industries, enjoyed perfect information, and produced homogeneous products.29

The essential challenge facing neoclassical economics, in the face of the rise of the giant, monopolistic or oligopolistic firm, was either to hold on to its economic model of perfect competition, on which its overall theory of general equilibrium rested, and therefore forgo any possibility of a realistic assessment of the economy—or to abandon these make-believe models in favor of greater realism. The decision at which neoclassical theorists generally arrived—reinforced over and over throughout the twentieth century and into the twenty-first century—was to retain the perfect competition model, despite its inapplicability to real world conditions. The reasons for this were best stated by John Hicks in his Value and Capital (1939):

If we assume that the typical firm (at least in industries where the economies of large scale are important) has some influence over the price at which it sells…[it] is therefore to some extent a monopolist…. Yet it has to be recognized that a general abandonment of the assumption of perfect competition, a universal adoption of the assumption of monopoly, must have very destructive consequences for economic theory. Under monopoly the stability conditions become indeterminate; and the basis on which economic laws can be constructed is therefore shorn away….

It is, I believe, only possible to save anything from this wreck—and it must be remembered that the threatened wreckage is the greater part of [neoclassical] general equilibrium theory—if we can assume that the markets confronting most of the firms with which we shall be dealing do not differ very greatly from perfectly competitive markets…. Then the laws of an economic system working under perfect competition will not be appreciably varied in a system which contains widespread elements of monopoly. At least, this get-away seems well worth trying. We must be aware, however, that we are taking a dangerous step, and probably limiting to a serious extent the problems with which our subsequent analysis will be fitted to deal. Personally, however, I doubt if most of the problems we shall have to exclude for this reason are capable of much useful analysis by the methods of economic theory.30

It is, I believe, only possible to save anything from this wreck—and it must be remembered that the threatened wreckage is the greater part of [neoclassical] general equilibrium theory—if we can assume that the markets confronting most of the firms with which we shall be dealing do not differ very greatly from perfectly competitive markets…. Then the laws of an economic system working under perfect competition will not be appreciably varied in a system which contains widespread elements of monopoly. At least, this get-away seems well worth trying. We must be aware, however, that we are taking a dangerous step, and probably limiting to a serious extent the problems with which our subsequent analysis will be fitted to deal. Personally, however, I doubt if most of the problems we shall have to exclude for this reason are capable of much useful analysis by the methods of economic theory.30

The choice economists faced was thus a stark one: dealing seriously with the problem of monopoly as a growing factor in the modern economy and thus undermining neoclassical theory, or denying the essential reality of monopoly and thereby preserving the theory—even at the risk of taking the “dangerous step” of “limiting to a serious extent the problems” with which any future economics would be “fitted to deal.” Establishment economic theorists have generally chosen the latter course—but with devastating consequences in terms of their ability to understand and explain the real world.31

In the United States in the 1930s, the issues of economic concentration and monopoly took on greater significance in the context of the Great Depression, with frequent claims that administrative prices imposed by monopolistic firms and restraints on production and investment had contributed to economic stagnation. The result was a large number of studies and investigations in the period, including Adolf A. Berle and Gardiner C. Means’s seminal The Modern Corporation and Private Property (1932) on concentration and the managerial revolution, and Arthur Robert Burns’s forgotten classic, The Decline of Competition (1936), addressing the effective banning of price competition in oligopolistic industries. These studies were followed by hearings on economic concentration conducted by the Roosevelt administration’s Temporary National Economic Committee, which, between 1938 and 1941, produced forty-five volumes and some thirty-three thousand pages focusing, in particular, on the monopoly problem.32 After the Second World War, additional investigations were conducted by the Federal Trade Commission and the Department of Commerce. In the words of President Roosevelt in 1938, the United States was experiencing a “concentration of private power without equal in history,” while the “disappearance of price competition” was “one of the primary causes of our present [economic] difficulties.”33

In his 1942 Capitalism, Socialism, and Democracy, Schumpeter famously responded to these New Deal criticisms of monopoly by trying to combine realism with a defense of “monopolistic practices,” viewed as logically consistent with competition in its most important form: “the perennial gale of creative destruction,” or what Marx had called the “constant revolutionizing of production.” Schumpeter argued that what mattered most were the waves of innovation that revolutionized “the economic structure from within, incessantly destroying the old one, incessantly creating a new one. This process of Creative Destruction is the essential fact about capitalism.” Yet such creative destruction, he recognized, also led to consolidation of capitals.

Pointing to oligopolistic industries, such as U.S. automobile production, he contended that “from a fierce life and death struggle three concerns emerged that by now account for over 80 per cent of total sales.” In this “edited competition,” firms clearly enjoyed a degree of monopoly power, behaving “among themselves…in a way which should be called corespective rather than competitive.” Nevertheless, such oligopolistic firms remained under “competitive pressure” from the outside in the sense that failure to continue to innovate could lead to a weakening of the barriers to entry, protecting them from potential competitors. It was precisely innovation or creative destruction that made the barriers surrounding the giant monopolistic firms vulnerable to new competitors. Indeed, if there were a fault in the giant corporation for Schumpeter, it lay not in “trustified capitalism” per se, but rather in the weakening of the entrepreneurial function that this often brought about.34

But it was John Kenneth Galbraith who best voiced the public sentiment with respect to monopoly and competition in the post-Second World War United States. Galbraith led the heterodox liberal assault on the conventional view in three influential, iconoclastic works: American Capitalism (1952); The Affluent Society (1958); and The New Industrial State (1967). Significantly, he launched his critique in American Capitalism with the concept of the ambiguity of competition. In neoclassical economics, the very rigor of the concept of competition was the Achilles heel of the entire analysis. This was best explained, he argued, by quoting Friedrich Hayek, who had insisted: “The price system will fulfill [its] function only if competition prevails, that is, if the individual producer has to adapt himself to price changes and cannot control them.” It was this definition of competition, as used by economists, Galbraith contended, that led to

an endless amount of misunderstanding between businessmen and economists. After spending the day contemplating the sales force, advertising agency, engineers, and research men of his rivals the businessman is likely to go home feeling considerably harassed by competition. Yet if it happens that he has measurable control over his prices he obviously falls short of being competitive in the foregoing sense. No one should be surprised if he feels some annoyance toward scholars who appropriate words in common English usage and, for their own purposes, give them what seems to be an inordinately restricted meaning.35

Galbraith argued that the typical industry in the United States was now highly concentrated economically, dominated by a handful of “very, very big corporations.” As long as the firms in the economy could be viewed in “bipolar classification” as consisting of either perfect competitors (small and numerous, with no price control) or monopolists (single sellers—a phenomenon practically nonexistent), the ideal competitive model worked well enough. But once oligopoly or “crypto-monopoly” was recognized as the typical case, all of this changed. “To assume that oligopoly was general in the economy was to assume that power akin to that of a monopolist was exercised in many, perhaps even a majority of markets.” Prices were no longer an impersonal force, and power and rivalry could no longer be excluded from economic analysis. “Not only does oligopoly lead away from the world of competition…but it leads toward the world of monopoly.”36

The reality-based view of monopoly had considerable currency in the postwar decades, even in economics departments, as Keynesians and liberals enjoyed prominence. Harvard economist Sumner Slichter, a free market advocate, lamented that “the belief that competition is dying is probably accepted by a majority of economists.”37 How much influence it had over government antitrust policies is another matter, but it is striking that a leading scholar and critic of monopolistic markets, John M. Blair, served as the chief economist for the Senate’s Subcommittee on Anti-Trust and Monopoly from 1957 to 1970. Blair was somewhat disappointed with the government’s inability to arrest monopoly power during these years, but in retrospect it seems like a period of robust public interest activism, compared with the abject abandonment of antitrust enforcement that began in the 1980s.38

Monopoly and 1960s U.S. Radical Political Economy

Marxian theory, as we noted, pioneered the concept of the monopoly stage of capitalism with the contributions of Hilferding and Lenin, but work in the area had languished in the early decades of the twentieth century. The more traditional Marxian theorists were content to rest on the case established by Marx in Capital based on nineteenth-century market conditions, with no attempt to extend the critique of capitalism to new developments associated with the monopoly stage.

The crucial step in the development of an essentially Marxist (or neo-Marxist) approach, however, arose with Michal Kalecki’s introduction of the concept of “degree of monopoly” (the power of a firm to impose a price markup on prime production costs) into the analysis of the capital accumulation process. Kalecki took the markup on costs as a kind of index of the degree of monopoly, and hence a reflection of the degree of concentration, barriers-to-entry, etc. His innovation, which was characteristically presented in just a few paragraphs in his Theory of Economic Dynamics (1952), was to show that the effect of an increased degree of monopoly/oligopoly would not only be to concentrate economic surplus (surplus value) in monopolistic firms, as opposed to competitive firms, but would also increase the rate of surplus value at the expense of wages (that is, the rate of exploitation).39

From here it was clear, as Josef Steindl was to demonstrate in Maturity and Stagnation in American Capitalism (1952), that the growth of monopolization created an economy biased toward overaccumulation and stagnation.40

The work of Kalecki and Steindl, evolving out of the concept of the “degree of monopoly,” became the crucial economic basis for Baran and Sweezy’s 1966 Monopoly Capital: An Essay on the American Economic and Social Order, which became the theoretical foundation on which radical political economics was to emerge, with the rise of the Union of Radical Political Economics (URPE), in the United States in the 1960s. Thus, the first major economic crisis reader published by URPE in the mid-1970s was entitled Radical Perspectives on the Economic Crisis of Monopoly Capitalism.41

For Baran and Sweezy, a fundamental change had occurred in the competitive structure of capitalism. “We must recognize,” they wrote at the outset of their book,

that competition, which was the predominant form of market relations in nineteenth-century Britain, has ceased to occupy that position, not only in Britain but everywhere else in the capitalist world. Today the typical economic unit in the capitalist world is not the small firm producing a negligible fraction of a homogeneous output for an anonymous market but a large-scale enterprise producing a significant share of the output of an industry, or even several industries, and able to control its prices, the volume of its production, and the types and amounts of its investments. The typical economic unity, in other words, has the attributes which were once thought to be possessed only by monopolies. It is therefore impermissible to ignore monopoly in constructing our model of the economy and to go on treating competition as the general case. In an attempt to understand capitalism in its monopoly stage, we cannot abstract from monopoly or introduce it as a mere modifying factor; we must put it at the very center of the analytical effort.42

Building on Kalecki’s degree of monopoly concept, Baran and Sweezy argued that Marx’s law of the tendency of the profit rate (as determined at the level of production) to fall, specific to competitive capitalism, had been replaced, in monopoly capitalism, by the tendency for the rate of potential surplus generated within production to rise. This led to a gravitational pull toward overaccumulation and stagnation: for which the main compensating factors were military spending, the expansion of the sales effort, and the growth of financial speculation.43 By exercising a tighter control over the labor process, and thus appropriating more labor power from a given amount of work, as Harry Braverman demonstrated in Labor and Monopoly Capital (1974)—and by being so much better able to search the globe for cheaper labor—the system was able to generate greater profits. So it was not just that more profits shifted to the monopolies—more profit was generated in the system itself.44

At the core of this analysis was the notion that price competition had been effectively banned by monopoly capital—as earlier depicted by Sweezy in his kinked-demand curve analysis. At the time Baran and Sweezy were writing Monopoly Capital, this had received strong confirmation in U.S. government hearings directed at the steel industry. Steel executives testified that they could only increase prices in tacit or indirect collusion with their oligopolistic competitors, adding that “we are certainly not going to go down” in price because that “would be met by our competitors”—resulting in cutthroat competition and a drop in profits. As Sweezy stated in the margins of his copy of the 1958 steel hearings: “They all but draw the kinky curve!”45 The result in oligopolistic markets, as Baran and Sweezy wrote, was a “powerful taboo” on price cutting.46 Through tacit collusion corporations tended increasingly toward a price system, which, as famously summed up by Business Week, “works only one way—up.”47 Giant oligopolistic firms were price makers—not price takers, as postulated by orthodox economics.

The value of this perspective is perfectly evident today. As billionaire Warren Buffett, the voice of monopoly-finance capital, declared in February 2011: “The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10 percent, then you’ve got a terrible business.” For Buffett, it is all about monopoly power, not management. “If you own the only newspaper in town, up until the last five years or so, you had pricing power and you didn’t have to go to the office” and worry about management issues.48

However, the corespective pricing strategies that turned oligopolistic markets into shared monopolies developed only gradually in the early twentieth century. It took time, Baran and Sweezy observed in Monopoly Capital, before corporate executives “began to learn the advantages of corespective behavior.” This often only occurred after a period of destructive price warfare. Indirect collusion, such as following the price leader, eventually solved this problem, generating widening gross profit margins for the giant corporations.49

In the Monopoly Capital perspective, competition was not eliminated, but rather its forms and methods changed, departing significantly from competitive capitalism. The powerful taboo against price competition did not extend to competition over low-cost position in the industry, most importantly through the reduction of unit labor costs—the main weapon of which was constant revolutionization of the means of production.50 Yet, under monopoly capital, cost reductions did not normally lead to price reductions, but simply to wider profit margins.

In place of the formerly predominant role occupied by price competition, other forms of competition, borne of oligopolistic rivalry, prevailed: product differentiation, sales management, advertising, etc. (what Baran and Sweezy called “the sales effort”) became the main means, outside of technological developments, in which firms sought in the short-run to increase their profits and market share. All such forms of competition, however, fell closer to the monopoly side of the spectrum, challenging both classical economic notions of free competition and, even more so, neoclassical notions of perfect competition.

At the same time, the giant corporations often held back on the development and release of new technologies if these did not fit with their long-term profit maximization strategies, an option unavailable under atomistic competition. Here Baran and Sweezy confronted Schumpeter’s claim that the “perennial gale of creative destruction”—the new method, the new technology—was the really significant aspect of competition, constantly threatening the giant corporations, “their foundation and their very lives.” In contrast, they argued that the modern giant corporations, or “corespectors” as Schumpeter called them, “as he knew well, were not in the habit of threatening each other’s foundations or lives—or even profit margins. The kinds of non-price competition which they do engage in are in no sense incompatible with the permanence of monopoly profits and their increase over time…. Schumpeter’s perennial gale of creative destruction has subsided into an occasional mild breeze which is no more a threat to the big corporations than is their own corespective behavior toward each other.”51

Central to the Monopoly Capital thesis was the notion that the tendency toward a system-wide average rate of profit, as depicted in classical and neoclassical economics, had lost its former meaning. The reality was one of a “hierarchy of profit rates,” highest in those industries where firms were large and concentrated, and lowest in those industries that were most atomistically competitive.52 The growth in the size of firms, economic concentration, and barriers to entry therefore served to feed ever larger agglomerations of corporate power. But this did not mean that there was no movement within this hierarchy, that large capitals would not come and go, some dropping out of the picture and new firms arising. Individual monopolistic firms were not invulnerable; industry levels of concentration could shift. The rise of new industries could lead to increased competition for a time, until a shakedown process occurred. But overall, the theory pointed to greater and greater concentration and centralization of capital, monopolization, and a hierarchy of profits.

Baran and Sweezy’s Monopoly Capital was based on a Marxian accumulation-based theory of the growth of the modern firm in which the increase in firm size and monopoly power went hand in hand with the drive to greater accumulation. From this perspective, it was hardly surprising that the typical giant corporation grew to be not only vertically integrated (embracing subsidiaries along its entire stream of production and distribution), and horizontally integrated (combining with firms in the same industry and at the same stage of production), but also evolved into a conglomerate and a multinational corporation. Conglomerates such as the DuPont Corporation had already begun to appear in the early part of the twentieth century. However, there was a qualitative difference in the post-Second World War U.S. economy in this respect. As Willard Mueller, a long-time analyst of the phenomenon, declared in 1982, “Now in much of the [U.S.] economy, conglomerate enterprise is no longer the exception but the rule.”53

Much more significant than even conglomeration, however, was the rapid growth of “multinational corporations,” a term coined by David Lilienthal, previously director of the Tennessee Valley Authority, in 1960, and then subsequently taken up by Business Week in a special report in April 1963. Multinational corporations, particularly emanating from the United States, were widely seen as increasingly menacing to states and peoples, not only in the periphery of world capitalism but also in some states of the developed core. For Baran and Sweezy, the rise of this phenomenon was not difficult to explain: multinational corporations represented monopoly capital abroad, with the giant corporations moving beyond their home countries, in the developed core of the system, to control resources and markets elsewhere. What multinational corporations wanted was “monopolistic control over foreign sources of supply and foreign markets, enabling them to buy and sell on specially privileged terms, to shift orders from one subsidiary to another, to favor this country or that depending on which has the most advantageous tax, labor, and other policies—in a word, they want to do business on their terms and wherever they choose.”54

In the 1960s orthodox economists scrambled desperately to address the new reality of a world economy increasingly dominated by multinational corporations, within the framework of a competitive model that left little room for monopoly power. They invariably sought to emphasize that such corporations were efficient instruments aimed at optimal allocation and were consistent with competitive markets, leading to a general equilibrium. Initial strategies to explain the growth of multinational corporations in the mainstream focused on such elements as: (1) different factor endowments of labor and capital between countries; (2) risk premiums in international equity markets; and (3) the need to expand firms’ markets while relying on internally-generated funds. None of this, however, got at the reality of multinational corporations in terms of accumulation and power.

It is in this context that economist Stephen Hymer, who was to become one of the leading radical economists of his generation before his tragic death in 1974, wrote his 1960 dissertation, The International Operations of National Firms: A Study of Direct Foreign Investment. He used the economics of industrial organization to uncover the reality of the multinational corporation, and directly inspired much of the critical work on the subject internationally.55 Breaking out of orthodox international trade and investment theory, Hymer saw the multinational corporation in terms of the search for global monopolistic power, in conflict with the traditional theory of competition. Although far less critical than Hymer, others such as Charles Kindleberger in his American Business Abroad, moved toward greater realism, adopting in part Hymer’s “monopolistic theory of direct investment.”56 Hymer’s work on the monopolistic influences in multinational corporate investment became so important that the United Nations volume on The Theory of Transnational Corporations, edited by John Dunning in 1993, begins with Hymer’s work as the first major source of a realistic theory.57

Magdoff and Sweezy’s “Notes on the Multinational Corporation,” published in 1969, depicted multinational capital as exhibiting the basic characteristics of monopoly capital, and reflecting the problem of overaccumulation in the advanced capitalist countries. The result was that “the monopolistic firm…is driven by an inner compulsion to go outside of and beyond its historical field of operations…. [Hence,] the great majority of the 200 largest nonfinancial corporations in the United States today—corporations which together account for close to half the country’s industrial activity—have arrived at the stage of both conglomerates and multinationality.”58 Financial corporations were to follow in subsequent decades in adopting multinational fields of operation.

Indeed, a key question today in understanding the evolution of the giant corporation is its relation to finance. Here the classical Marxian analysis was ahead of all others. In Marx’s concept of the modern corporation or joint-stock company, the most important lever—other than the pressure of competition itself (and abstracting from the role of the state)—in promoting the centralization of capital, was the development of the credit or finance system. The rise of the modern firm, first in the form of the railroads, and then more generally in the form of industrial capital, was made possible by the growth of the market for industrial securities.59 Finance thus led to centralization. In 1895, just before his death, Engels was working on a two-part supplement to Marx’s Capital, the second part of which, entitled “The Stock Exchange,” remained only in outline form. It started with observations on the rise of the industrial securities market, tied this rise to the fact that “in no industrial country, least of all in England, could the expansion of production keep up with accumulation, or the accumulation of the individual capitalist be completely utilised in the enlargement of his own business,” and saw this tendency toward overaccumulation as the general economic basis of the founding of giant capital and the acceleration of an outward movement toward world colonization/imperialism.60 Both Hilferding’s Finance Capital and Veblen’s The Theory of Business Enterprise focused on finance as a lever of monopoly.

Although industrial corporations were later to generate so many internal funds that they became, for a time, largely free of external financing for their investment, their very existence was associated with a vast expansion of the role of finance generally within the accumulation process. With the slowing down of economic growth beginning in the 1970s, corporations, unable to find outlets in productive investment for the enormous surplus they generated, increasingly turned to mergers and acquisitions and the associated speculation in the financial superstructure of the economy. The financial realm responded with a host of financial innovations, encouraging still further speculation leading to an economy that, while increasingly stagnant—i.e., prone to slow growth at its base—was being continually lifted by the growth of credit/debt. This phase in the development of monopoly capital is, we believe, best described as a shift to monopoly-finance capital.61

Neoliberal Newspeak: Monopoly Is Competition

The left embrace of monopoly at the heart of its critique of capitalism was hardly emulated by mainstream economists. To the contrary, over the course of the 1970s and certainly by the early 1980s, the field went in precisely the opposite direction. The neoliberal shift to a “leaner, meaner” capitalist system brought the “free market” economics of the Chicago School into a position of dominance. The ideas of Hayek, Friedman, George Stigler, and a host of other conservative economists now ruled the profession. Traditional Keynesians and institutionalists—those more sympathetic to reality-based assessments of monopoly—not to mention left economists, found themselves marginalized.

The victory of neoliberal economics was not the result of superior debating techniques or stellar research. It is best viewed as the necessary political-economic policy counterpart to the rise of monopoly-finance capital.62 More specifically, it can be described as a response to the changes in accumulation and competition associated with a new phase of stagnant accumulation in the capitalist core, and to the associated financialization of the global economy. The general transformation in capital’s global imperatives in the 1970s and ’80s was powerfully described by Joyce Kolko in 1988 in Restructuring the World Economy:

Capital continues to flow in quest of profit, and this process itself objectively restructures the economy—through accretion, not as a consequence of a strategy or a plan. But profit since the 1970s is found primarily in financial speculation and commercial parasitism, and in other ephemeral services, rather than in production…. The phenomenal growth of financial “product innovations” in the 1980s, the internationalization of equity markets, the stampedes of currency speculations by banks and corporations gambling for a quick return…all follow the laws of capitalism…. The banks themselves have been transformed from being lending units to being financial speculators…. At the same time that capital is being concentrated in huge conglomerates and trading companies…. Growing competition in the capitalist world economy has created overcapacity in all sectors—finance, basic industry, and commodities—inhibiting investment and encouraging nonproductive financial speculation.63

These changes initially came about, as Kolko said, through “accretion”—as a result of capital’s drive to overcome all limits to operations in the context of a global economic crisis, beginning in the mid-1970s. But they soon led to the development, through the state and international organizations, of a political-economic counterattack against all forms of restraints on capital, including the welfare state, business regulation, recognition of unions, antitrust, controls on foreign investment, etc. This then became the neoliberal project of economic restructuring. Increasingly, corporations contracted out labor in order to weaken unions and reduce costs, and relied on greater global sourcing of inputs, taking advantage of low wages in the periphery.64 Global competition between corporations increased, but it did so in Marx’s sense of constituting a lever, along with finance, for the greater centralization of capital.

Key to this resurrection of neoliberal ideology was the newly articulated claim that perfect competition existed effectively in reality, and not simply on the blackboard. Economic concentration and monopoly were no longer to be considered significant, despite more than a century of growing concentration. This aspect of neoliberal economics, which deftly exploited the ambiguity of competition, was crucial in changing the entire debate about monopoly among scholars, policymakers, activists, and the general public.

The most important theoretical development in sidelining the traditional issue of monopoly power was a new theory of the emergence of the firm rooted in the concept of transaction costs. In 1937 Ronald Coase (who was to join the University of Chicago economics department in 1964) had written his now famous article “The Nature of the Firm,” which argued that the reasons for corporate integration (particularly vertical integration) had to do with reducing external transaction costs arising from purchasing inputs within the market, as opposed to producing them internally within a given firm. Vertical integration, when it took place, was then seen as a way in which firms optimized on costs and “efficiency” by reducing transaction costs rather than an attempt to generate monopoly power.

The introduction of transaction costs into economics was an important innovation. But Coase’s purpose was clear. As he later recalled, “my basic position was (and is)…that our economic system is in the main competitive. Any explanation therefore for the emergence of the firm had to be one which applied in competitive conditions, although monopoly might be important in particular cases. In the early 1930s I was looking for an explanation of the existence of the firms which did not depend on [the drive to] monopoly. I found it, of course, in transaction costs.”65

Coase’s argument in “The Nature of the Firm” had little influence until the late 1970s and ’80s, but was increasingly seized, with the ascendance of free market conservatism, to attack all notions of monopoly power, and to challenge traditional industrial organization theory and antitrust actions.66 With the new emphasis on transaction costs, all developments in firm integration were interpreted as optimizing “efficiency,” while the question of monopoly power was largely set aside as irrelevant.

It should be noted that recourse to arguments on “efficiency” in this sense is suspect since circular in nature, justified in terms of “market exchange” as the benchmark, which is seen as efficient by definition. In this perspective, greater profits and accumulation are presumed to be indictors of efficiency and then justified because they are…efficient. It is not fewer hours of some standard labor that are “efficient” by this criterion, but lower unit labor costs, since this directly enhances profits.67

Coase’s transaction cost analysis was later carried forward in Oliver Williamson’s influential 1975 Markets and Hierarchies, which extended its putative claims with respect to “efficiency,” and was aimed specifically at moderating antitrust attacks on monopolies, oligopolies, vertically integrated firms, and conglomerates.68

In the analysis of the growth of multinational corporations at the global level, transaction cost analysis was heavily emphasized by those sympathetic to corporations. It also provided a basis for rejecting and ultimately ignoring the interpretation based on monopoly, pioneered by Hymer, Baran, Sweezy, Magdoff, and radical critics across the globe. Transaction costs were presented as external to the multinationals. Global corporations were thus said simply to be operating more “efficiently” by incorporating elements of the global economy into their internal processes, and thereby reducing their external transaction costs. Monopoly rents were no longer deemed central. Placing a disproportionate emphasis on transaction costs, mainstream economists increasingly criticized Hymer’s theory of monopoly power as the key to understanding the growth of multinational corporations. Power was no longer a central issue in the analysis of the global corporation.69

A more concerted attempt to bring back perfect competition to its former glory as part of the new neoclassical-neoliberal program was promoted and advocated by George Stigler. In his Memoirs of an Unregulated Economist (1988), Stigler emphasized that a central objective of Chicago school economics was the destruction of the concept of monopoly power in all of its aspects (including its connection to advertising). He also made it clear that his own work had been particularly concerned with countering “the growing socialist critique of capitalism [which] emphasized monopoly; ‘monopoly capitalism’ is almost one word in that literature.”70 Although Stigler claimed that Marx’s theory of concentration and centralization was a deviation from the main line of Marxist theory, he nonetheless thought it a considerable threat to neoclassical economics and the ideology of capitalism.71

In an article titled “Competition” for the New Palgrave Dictionary of Economics in 1987, Stigler started with a broad definition of competition as “rivalry” between individuals, groups, and nations in order to paper over the ambiguity of competition, and then quickly slipped into competition in economic terms, without clearly distinguishing the two. Perfect competition was then brought in as the real content of competition and as a “first approximation” to the real world of competition. While “workable competition,” as it prevailed in the economy, was depicted as essentially in reality what perfect competition was in pure theory: i.e., an economy that operated as if numerous small firms constituted the representative case. He concluded: “The popularity of the concept of perfect competition in theoretical economics is as great today as it has ever been.”72

At the same time, operating from the opposite tack, a Chicago School argument on the positive aspects of monopoly, building on Stigler’s 1968 The Organization of Industry, was developed. This approach invariably saw monopoly power as (1) reflecting greater “efficiency”; (2) collapsing quickly and reverting to the competitive case; and (3) involving short-term monopoly profits that were eaten up in advance by the costs of obtaining a monopoly. Monopoly was thus naturally fleeting and rapidly turned into competition, so it could be ignored. This was accompanied by a considerable rewriting of history, with Stigler and his colleagues, for example, attempting to deny the predatory pricing policies that had led to the rise to dominance of Rockefeller’s Standard Oil.73

In general, neoclassical economics in the era of neoliberal triumph, beginning in the late 1970s, promoted versions of economics that eschewed reality for pure market conceptions. Rational expectations theory (in which the ordinary economic actor was credited with absolute rationality, to the point of utilizing higher mathematics in making everyday economic decisions) was designed to deny that government could play an affirmative role in regulating the economy. The efficient market hypothesis was designed to deny categorically at the theoretical level anything but “efficient” outcomes in the realm of finance.74

With respect to competition, the conservative vogue became “contestable markets theory.” Billed as a “new theory of industrial organization,” the goal of this theory, as explained by its foremost proponent William Baumol, was to demonstrate that competition and efficiency did not require “large numbers of actively producing firms, each of whom bases its decisions on the belief that it is so small as not to affect price,” as in perfect competition theory. Rather, contestable markets theory posited “costlessly reversible entry” or absolutely free entry and exit to industries by potential competitors.75 The barriers to entry that constituted the basis of conceptions of monopoly power were abolished by fiat at the level of pure theory. In particular, economies of scale were no longer seen as an advantage for a given firm, constituting a substantial barrier to entry. Instead, what was postulated was ultra-free entry even in such cases. Antitrust actions were therefore no longer necessary. Contestability theory was used in the 1980s to promote airline deregulation; which then proceeded to produce exactly the opposite of what the theory had suggested, leading to shared monopoly or oligopoly. In the end, “the theory of purely contestable markets,” as industrial organization theorist Stephen Martin observed, “is presented as a generalization of the theory of perfectly competitive markets.” In effect, perfectly competitive markets exist, even where the conditions of perfect competition do not pertain. Markets are inherently free, except in cases of state or labor interference.76

Antitrust law enforcement in the new neoliberal period was heavily influenced by the arguments of Robert Bork in his book The Antitrust Paradox. Bork was a student of Williamson’s work (though focusing on “efficiency” and not transactions costs) and that of the Chicago School. He claimed that monopoly was rational, fleeting, and readily dissipated by new entry. Referring to monopolistic and oligopolistic market structures, Bork wrote: “My conclusion is that the law should never attack such structures, since they embody the proper balance of forces for consumer welfare.”77 Since consumer welfare was the object of public policy in this area, any antitrust actions threatened to go against the consumer interest by generating “inefficiency.” The issue of monopoly power was simply irrelevant.

To give some sense of how mainstreamed the new neoliberal mantra became, nearly all of the major conservative economists making the case that the corporate status quo was by definition competitive and the best of all possible worlds—Hicks, Hayek, Friedman, Stigler, Coase, and Williamson—were all awarded the Bank of Sweden’s Nobel Memorial Prize in Economic Sciences.78

Monopoly and the Left

Above all else, it was the growth of global competition that seemed to make the monopoly question less pressing to economists. For Stigler, it was the “potential competition” from multinational corporations in other countries, symbolized by the declining national and international position of the U.S. steel and automobile industries in the 1970s, that led to widespread “skepticism about the pervasiveness of monopoly.”79