Richard Peet

Over the last thirty years, capital has abstracted upwards, from production to finance; its sphere of operations has expanded outwards, to every nook and cranny of the globe; the speed of its movement has increased, to milliseconds; and its control has extended to include “everything.” We now live in the era of global finance capitalism.

The term “finance capital” comes from Rudolf Hilferding, the Austro-German Marxist theoretician. He was categorizing an increasing concentration and centralization of capital in large corporations, cartels, trusts, and banks.1 For Hilferding, the earlier competitive “liberal capitalism,” opposed to intervention by the mercantilist state, was transformed at the turn of the century into monopolistic “finance capital” which was integrated into a “centralized and privilege-dispensing state.” He thought that flows of investment capital served to integrate the nascent global economy, which was operating predominantly under the control of the City of London, then the leading power center. Hilferding saw finance capital engaged in vigorous expansion, constantly searching for new spheres of investment and markets. The similarities between the turn of the nineteenth century and the turn of the twentieth are striking.

More recently, David Harvey has argued that ownership (share holders) and management (CEOs) of capitalist enterprises have fused together, as upper management is increasingly paid with stock options.2 Raising the price of its stock becomes the objective of corporate operations. Productive corporations compete by generating rapid increases in the price of the corporation’s stock, immediately through gimmicks and trickery, but more basically through firing workers, moving production, and raiding pension funds. Corporations heavily involved in production—automobile or steel makers, for example—have become increasingly financial in orientation, diversifying into credit, insurance, real estate, etc. Harvey says that all of this is connected to the burst of activity in an increasingly unregulated, and rapidly globalized, financial sector which is engaged in a process that he describes, similarly to Randy Martin,3 as “the financialization of everything”—meaning control of all areas of the economy by finance. The tremendous economic power of the new entrepreneurial-financial class enables vast influence over the political process. As John Bellemy Foster and Hannah Holleman put it, “the financialization of U.S. capitalism over the last four decades has been accompanied by a dramatic and probably long-lasting shift in the location of the capitalist class, a growing proportion of which now derives its wealth from finance as opposed to production. This growing dominance of finance can be seen today in the inner corridors of state power.”4

Financialization has involved increasingly exotic forms of financial instruments and the growth of a shadow-banking system, off the balance sheets of the banks. The repeal of the Glass-Steagall Act in 1999 symbolized the almost complete deregulation of a financial sector that has become complex, opaque, and ungovernable.

Although these are useful ideas, they only begin a full analysis of finance capitalism. Where did finance capitalism come from? Did neoliberal policy create finance capitalism? Does finance capital exploit differently from industrial capital? And, most importantly, what are the central contradictions that generate crises in finance capitalism?

Origins in the Neoliberal Policy Regime

A policy regime is broader than specific policies, such as regulation or deregulation of the financial sector. Rather, it indicates a systematic approach to policy formation by a set of government or governance institutions which deals with a definable, limited range of issues. It prevails, as the dominant state-interventionary framework, over a historical period lasting at least several decades.5 Policy regimes are lent coherence by underlying political-economic interpretations of the causes of related socio-economic problems that mark a crisis in capitalism of a certain kind, like industrial or financial capitalism. This interpretation represents the interests of a certain fraction of capital, as with finance, and a certain class fraction, like investment bankers, upper-level bureaucrats, and famous economists—the “policy elite.” Interpretations of crises are central, ideological aspects in class struggle. Ideologies that lend consistency, cohesion, and believability to policy regimes are constructed by experts residing in geographic centers of ideological power (“idea cities”), with the ideological work carried out in prestigious, elite institutions.

Since the Second World War, the capitalist world has seen two main political-economic policy regimes: Keynesian democracy, predominating between 1945 and 1973 and forming the last stage of corporate industrial capitalism; and neoliberal democracy, predominating between 1980 and the present, and constituting the formative stage of financial capitalism; the years 1973–80 represent a transitional period between regimes. The Keynesian policy regime was characterized by countercyclical macroeconomic management by an interventionist, regulatory state committed to achieving full employment and higher incomes for everyone. This regime responded to the Depression of the 1930s, the major crisis in corporate industrial capitalism, when the system had to compromise with labor in order to survive, by using state authority to stabilize accumulation and partly to democratize economic benefits. The convention is that Keynesianism entered into crisis in the 1970s characterized by stagflation—high rates of inflation coinciding with high rates of unemployment—which automatically brought about its demise. But stagflation merely precipitated the rise of long-gestating, anti-Keynesian interpretations of economy and policy, by Friedrich von Hayek, Milton Friedman, and other representatives of neoliberalism. The successor, the neoliberal policy regime, revived late-nineteenth-century, free-trade liberalism by withdrawing the nation state from macroeconomic management in the interest of the working class, but re-intensified state intervention on the side of finance capital. The neoliberal regime responded positively to the globalization of economy, society, and culture of the late twentieth century. Indeed the neoliberal regime helped to organize the emergence of a particular kind of globalization that benefits the newly reemergent, super-wealthy, financial-capitalist class, mainly living in the leading Western countries, especially the United States, but operating transnationally in terms of investment activity.

Dividing the postwar era into these two periods, the Keynesian-social democratic policy regime up to 1980 and the neoliberal policy regime dominant after, we can compare the results of two, intra-capitalist forms of social economy. The measure used by conventional economists to measure economic well-being is economic growth—“growth is good.” Economic growth in the OECD countries, the richest in the world, averaged 3.5 percent a year in the period 1961–80, basically during Keynesianism, and 2.0 percent a year in 1981–99, basically during neoliberalism. In developing countries (excluding China) the equivalent figures were 3.2 percent and 0.7 percent.6 In other words, Keynesianism vastly outperformed neoliberalism in conventional (mainstream) terms. So why were all those number-crunching economists not adherents of Keynesianism in the 1980s and ‘90s? The answer can only be that mainstream economics is not “science for humanity,” but rather “ideology on the side of capital.”

The trouble is that economic growth is an ideological indicator of societal well-being. It is possible for economic growth to be accompanied by rising social inequality so that all the income increase goes to a few people. Of the 80 percent of global income going to rich countries, 50 percent typically goes to the highest-income 20 percent of the people, while the lowest income 20 percent in the rich countries get 5–9 percent, depending on the country. At the other end of the world, in the low income countries, the richest 20 percent typically get 50–85 percent of national income, while the poorest 20 percent typically get 3–5 percent…of the mere 3 percent of global income that these poor countries receive.7 The richest 2 percent of the world’s adult population now owns more than half of global household wealth. The bottom half of adults own barely 1 percent.8

The great unmentioned fact about global income distribution is this: poverty results from inequality. Poverty increases as the world becomes a more unequal place. So what has been happening to inequality under neoliberalism? Take the case of the leading capitalist society, the United States, “neoliberal model for the rest of the world.” Between 1947 and 1973, under the Keynesian policy regime, every income category of people experienced real-income growth, with the poorest families having the highest rate of growth of all. This temporary period legitimated the notion that “growth is good for everyone.” After 1973, average real income not only remained stagnant, but that average reflected high income growth for the top 20 percent of families, and significant income decrease for the poorest 20 percent, so that almost half of all families received lower real incomes by the mid-1990s than they had in 1973.9 The key factor causing these secular changes in class incomes was an even greater divergence in the ownership of wealth, especially financial wealth—that is bank accounts, ownership of stocks and bonds, life insurance, and mutual fund savings. Particularly important is ownership of stocks and mutual fund shares. Despite “democratization” (retirement savings invested in mutual funds, etc.) only 27 percent of U.S. families own stocks. While 78 percent of the richest 20% families own stocks and mutual funds, 3 percent of the poorest 20% families do so. The “equalizing” trends in wealth ownership of the entire, state interventionist, period between the 1930s and the ‘70s (New Deal, War Economy, post-war Keynesianism) were reversed sharply in the neoliberal 1980s, so that by 1989 the richest 1 percent of households owned almost half of the total financial wealth of the United States. The wealthiest 1 percent of the U.S. population owns 49.7 percent of total investment assets, while the bottom 90 percent owns 12.2 percent.10

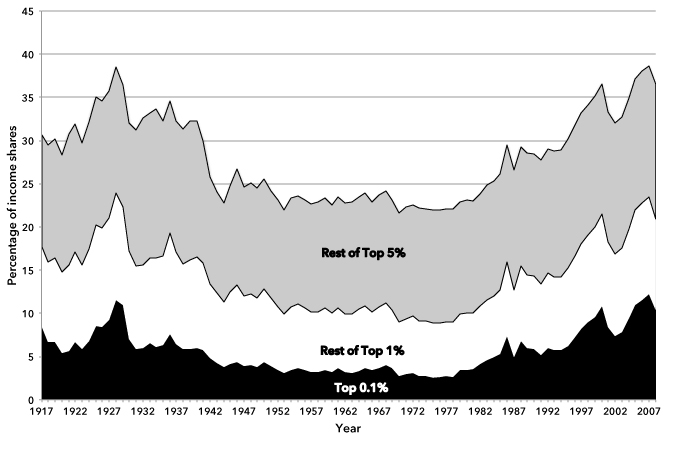

These secular shifts produce the defining U-shape to the history of upper-class incomes under capitalism over the last hundred years. Chart 1 shows the percentage of income going to the highest income 0.1 percent, 1.0 percent and 5.0 percent of the U.S. population.11 It is based on tax returns, which tend to understate income going to the rich, if only because the rich hide their money better and employ tax accountants more skilled than the bureaucratic accountants used by the Internal Revenue Service. Using the highest income 1 percent as a surrogate for the “capitalist class,” between 1917 (when the historical tax data begin) and the late 1930s, capitalists under classical liberalism received between 15 and 25 percent of total reported income, with a peak occurring in 1929, as the Great Depression began. Between 1945 and 1979, under the Keynesian policy regime, this proportion dropped, to a quite consistent 10 percent. Then under the neoliberal policy regime, the percentage rose again to 15–25 percent, with a peak occurring in 2007, as the Great Recession started. In other words liberalism and neoliberalism produce economic growth that exclusively benefits the rich and super rich in terms of income. Intervention, even by the relatively non-interventionist, “liberal-democratic” Keynesian state in the United States, reduces the proportion of income going to the super rich and redistributes income and state-subsidized services to the poorer sections of the population. Neoliberalism is development for the already-rich. This can be taken as indubitable fact.

Examining data for fifteen countries with comparable time series, Thomas Piketty and Emmanuel Saez find the historical U-shape to be typical for nine countries (UK, United States, Canada, Australia, New Zealand, India, Argentina, Sweden, and Norway), by comparison with a group of six countries where the share of the top 1 percent was high during liberalism, dropped during Keynesianism, and has remained low since (France, Germany, Switzerland, Netherlands, Japan, and Singapore).12 Countries in the former, U-shaped group of countries are neoliberal, where the state intervenes exclusively on behalf of the capitalist class. The latter countries are Keynesian/social democratic remnants, where notions of regulating the economy on behalf of everyone have diminished but still linger faintly on—some people call this the “European Social Model.”13 The neoliberal policy regime, stressing unfettered profit-making as the driving force in capitalist expansion, deliberately redirects the economy towards producing more and more income for people who cannot possibly consume it, no matter how hard they try, and therefore must save and invest. Neoliberal policy results in the accumulation of huge surpluses in the hands of relatively few people—150,000 “tax-paying units” in the United States, and perhaps 1 million people in the global capitalist class. In the neoliberal regime, income from business and capital investment overwhelm even high CEO salaries leading to immense accumulations in the hands of very few people. The accumulation of these immense income surpluses as capital under neoliberalism was the leading social force in the recreation of late-twentieth-century finance capitalism. Neoliberal policy deliberately constructed the main ingredient of finance capitalism—overaccumulation of money capital in the bank accounts of the wealthy few.

Chart 1: Top Fractiles Income Shares (Including Capital Gains) in the United States (1917–2008)

Source: Piketty and Saez (2003)

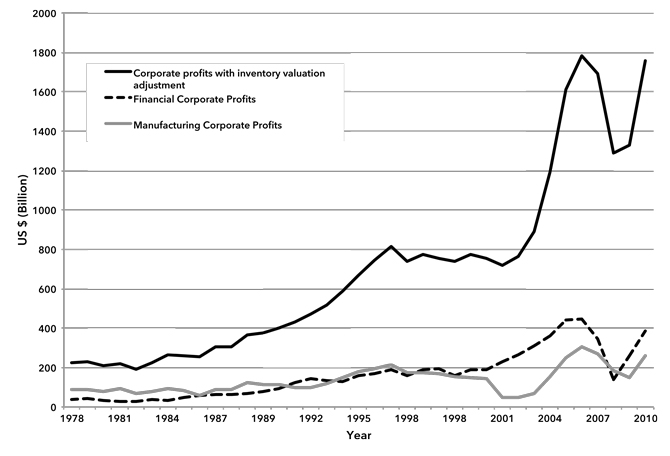

We can date the transition from industrial to financial capitalism with some accuracy. Let us start with the assumption that capitalist enterprises exist to make profit, and that the volume of profit is the leading feature characterizing an economic sector. Using data on corporate profits by industry, we find in the United States that manufacturing corporations were the dominant profit makers throughout the post-Second World War period, typically making half of all corporate profits. Until the early 1980s, financial corporations were of lesser importance, typically making less than 15 percent of all corporate profits. Over a longish transition (1986–2000) manufacturing and finance made similar proportions of the rapidly rising total corporate profits typical of the neoliberal policy regime. Since about 2000 finance has made a lot more profit than manufacturing in every year except for 2008, at the height of the financial crisis (Chart 2). In other words, finance capitalism rose to compete with industry in the late 1980s and ‘90s and became the dominant social formation at the turn of the twentieth century (1999 actually). This was not a contingent or haphazard turn of superficial events, but resulted from systematic tendencies in policy making and class struggles that included contentions within the corporate capitalist elite (industrial versus financial capitalist fractions).

Chart 2: Corporate Profits with Inventory Valuation Adjustment United States (1978–2010)

Source: US Department of Commerce, Bureau of Economic Analysis

Under post-Second World War Keynesianism there was a partial “socialization” of wealth accumulation in the form of private pensions and other collective savings and retirement funds, mostly by unionized or otherwise privileged workers. Some (mainly “middle class”) workers have managed to retain diminished Keynesian-style benefits—public sector employees, for example—but they are a shrinking group under neoliberal attack over the last few years. The leading class fraction in wealth accumulation is what the investment banks call “high net worth individuals,” by which is meant super-wealthy families, CEOs, upper managers, entrepreneurs, etc. In the last instance, this class of wealth holders (“owners”) has the determining power in the economy and the polity. In the more immediate instance, everyday economic power is exercised by the wealth managers (“agents”)—investment bankers, bond traders, brokers, investment analysts, and a coterie of other well-paid financial experts. Finance capitalist agents exercise power by controlling access to the markets through which capital accumulations become investments, directing flows of capital in various forms—as equity purchases, bond sales, direct investment, etc.—to places and users that are approved by the financial analytic structure of the Wall Street and City of London banks and investment firms. The gaze of the “investment analyst” representing the “confidence of the market” is the active form taken by the financial capitalist interest, although “investor confidence” is presented as somehow neutral and technical, in the best long-term interest of everyone—“professional economics” is to blame for this misrepresentation. The accumulation of surplus in the relatively few hands of the super-wealthy intensifies the financial component of capitalist growth and increases the power of the financial capitalist class fraction over not just the industrial fraction, but everyone else as well. Control over investment capital and financial technical expertise gives finance capital and its banking representatives tremendous power—over policy making, over economies, over employment and income, over advertising and image-production…over everything. Production, consumption, economy, culture, and the use of environments are subject to a more removed, more abstract calculus of power, in which the ability to contribute to short-term financial profit becomes the main concern.

At the other end of the social spectrum, in 2010 the number of U.S. wage and salary workers who were union members was 14.7 million, or 11.9 percent of the work force, down from 17.7 million, or 20.1 percent, in 1983. In the private sector, 6.9 percent of workers are members of unions.14 De-unionization, in the context of globalization of production, limits the bargaining power of the working class. Thus we find real wages (in constant 1982 dollars), that had risen sharply under Keynesianism, reaching a plateau in the 1970s, and remaining flat (even declining) under neoliberalism.15

Exploitation in Consumption

On the one hand, we find the overaccumulation of income in the hands of a few. On the other hand, we find the majority of people with stagnant or declining real incomes, threatened by globalization, and with little collective bargaining power. And yet everyone is subject to sophisticated inducements to consume. The continuation of high mass consumption is enabled not by working class incomes, but by globalization of the production of cheap electronics, clothing, food, etc. With stagnant real incomes, the “consumption-to-the-max” that began under Keynesianism and Fordism, but remains typical of neoliberal societies, requires credit and going into debt. So inequality produces indebtedness at all levels, from consumers to industries to states, and in all aspects of life. This results in a newly intensified form of a long-existing exploitation known as “debt peonage.”

Whereas industrial capitalism primarily exploits productive workers through the wage system, finance capitalism adds the exploitation of consumptive individuals via indebtedness. The idea is to have everything bought not with dollar bills or pound notes, but with maxed-out credit cards, so that purchases yield several years of interest at far-higher rates than banks pay on deposits (20 percent as compared with 2 percent). The commercial banks and a range of other unregulated lenders of last resort (“no credit record, no problem”) reap the difference. The investment banks join in by speculating on this vast pool of debt, as with mortgage bundling and credit default swaps, where quick and easy money is made in large quantities.

And then there are the various, highly sophisticated financial maneuvers to increase, and then decrease, commodity prices via the futures markets—for example petroleum in early 2011, when the price of oil for light, sweet crude went from $86 a barrel on February 11, to $110 on April 15, although there was no immediate shortage on the world market. The name for this version of financial exploitation is price gouging. The cost is borne by people as consumers not just through exorbitant mortgage payments and high gasoline prices directly, but also through losing your house, homelessness, not being able to get to work, or the sacrifices made in avoiding these working family catastrophes—all this pain and suffering just to make rich people even richer!

In other words, finance capitalism intensifies old methods or invents new methods of exploitation, and new modes of discipline, that pass mainly through the sphere of reproduction rather than the sphere of production: credit cards and bank loans; inflated house prices; high commodity prices due to commodity futures trading; and a long list of similar mechanisms thought up by sharp financial agent minds. This intensified exploitation which functions through the medium of debt peonage, price gouging, and other, similar devices, is the economic and cultural basis for the worst excesses of finance capitalism.

Crisis 1: Finance

Now we come to the dangerous bit. Neoliberalism is a way of running the economy that produces dramatic price increases on the stock exchange, where the rich put their money to make even more. But stocks and shares are a relatively safe bet, compared with neoliberalism’s other “irrational exuberances,” like the vast financial apparatus surrounding the swollen credit market. Disaster strikes when, as in 1929 and 2007, the proportion of money going to the super-rich 1 percent rises towards 25 percent, far-exceeding requirements for productive investment, and necessitating speculation to increase returns. For the price of high returns is…eternal risk. Any investment fund that does not generate quick and large returns (and therefore does not take on extreme risk), suffers disinvestment in highly competitive markets, where money changes hands in computer-quickened moments. So there is a competitive compulsion to take increasingly daring risks in search of higher returns that temporarily attract investment. Financial managers overseeing capital accumulations compete for control over assets by promising these returns. Those that fail to deliver high profit-rates disappear to be replaced by “more aggressive” investment analysts. So debt, speculation, risk, and fear are structurally endemic to finance capitalism, in what Alan Walks calls “Ponzi Neoliberalism.”16 Fear itself becomes the source of further speculation—buying gold or futures, for example. Debt and gambling spread from Wall Street into all sectors of society—house prices, state lotteries, casinos, numbers games, bingo at the church hall, sweepstakes, Pokémon cards—everyone gambles, even little kids.

The interlocking of these speculations is the source of their intractability. So the financial crisis that began in 2007 had the following moments: vastly overpriced housing particularly near booming financial centers; competition among financial institutions to offer easy credit that makes everyone hopelessly indebted; the bundling of home mortgages and other debts into tradable paper; very high levels of leveraging; and the use of assets whose value can disappear in an instance to securitize other, even more risky, investments. It is not just that crisis spreads from one area to another. Its more that crisis in one (like the inevitable end to the housing price bubble) had exponential effects on the others (investment banks overextended into high risk speculations) to the degree that losses accumulated that tested the rescuing powers even of client states and governance institutions. Hence inequality is not merely unethical—it is dangerous. The combination of debt and speculation, deriving from inequality, produces an inevitable tendency towards repeated financial crises.

Crisis 2: Disarticulation

However, financial crisis has catastrophic effects in capitalist economies already weakened by deindustrialization. The dominance of finance capitalism over industrial capitalism was enabled by a rapid change in the productive structures of most Western countries over the last thirty years. A disastrous loss of the industrial component resulted in widespread losses in manufacturing employment. U.S. manufacturing employment peaked in 1979 at almost 20 million, and fell under neoliberalism to about 11.5 million in 2010. Politically, this weakened the organized labor base of the Democratic Party. Realizing this, Bill Clinton’s “genius” was to switch allegiance from a declining organized labor to an ascending financial sector. The Democratic Party has belonged to finance ever since. Economically, this is important because unionized industrial workers struggled for higher wages matched with increased productivity. High mass wages were the main source of the boom in consumption that fueled the economic growth of the post-war period—manufacturing still pays higher-than-average wages. Deindustrialization decreases worker incomes and undercuts mass consumption, which weakens the central Fordist symbiosis that underlies modern capitalism and causes realization crises. In the longer term, deindustrialization leads to what might be termed a “disarticulated economy.” This is an economy deficient in key structural components, like manufacturing, so that growth in one sector does not lead to growth in linked others. The map of the economy looks like a slice of Swiss cheese.

Where did all the good jobs go? At first to new industrial countries, like Mexico and South Korea, but more recently to China, where employment in manufacturing doubled as U.S. employment fell almost in half. Obviously the main reason for the change in the global geography of employment is that hourly compensation costs in manufacturing (wages plus benefits) amount to $1.50 or less in China, compared with $33.50 in the United States. The neoliberal response to global wage discrepancy is: let China do the manufacturing. This is based on the liberal ideal of free trade, and this in turn on Ricardo’s (completely wrong) theory of comparative advantage.17 Global industrial corporations profit no matter where the products are made. Investment banks love “emerging markets,” while chaos in the world economy gives lots of opportunities for futures, derivatives, currency, and other highly profitable speculative instruments.

There is, however, another view of deindustrialization and “free” trade, based on a different conception of economics in which the “cost of production” goes beyond the wage bill to include a broader socio-economic expense. From this view, any country that deliberately allows the disappearance of those high-paying, unionized, permanent jobs that support the entire production-consumption nexus is asking for trouble: the long-term, structural weakness of deindustrialized economies and the failure of the supposed transition to high-valued, knowledge-based economies.

Trouble appears with ferocity at times of economic crisis. The Keynesian response to recession is to stimulate the economy through fiscal and monetary policy. Tell consumers to go out and buy that new appliance, and set teaser rates low, so they can buy on credit. Yet in a disarticulated economy, the Keynesian multiplier does not work—spending in one area does not translate into employment and incomes in other linked areas within a primarily national economy. Instead, it is more a case of a leaky multiplier. So what is the result of going out to spend? Even more consumer debt in a recessed United States and a boom in the already overheated Chinese economy. Keynesianism as we knew it has been rendered obsolete by over-globalization. There is no effective policy response to crisis in disarticulated economies, and that is the more basic reason that recession lasts.

Crisis 3: Environment

If this was all, we might escape irrational exuberance and disarticulation and live to criticize another day. But the worst is yet to come, as the environment strikes back. The risk endemic to finance capitalism extends to risky environmental relations. Capitalist culture becomes risk-ridden, short-term in memory and anticipation, and careless about consequences—living for the moment, without regard for the environmental future. Production, consumption, economy, and the use of environments are subject to a more-removed-from-reality, more abstract calculus of power, in which ability to contribute to short-term financial profit becomes the main concern, and long-term consequences are not so much ignored as glossed over, through sophisticated corporate advertising, think tank excuses, and pseudo-green propaganda (“we too care about the environment”). Corporations that make extremely risky decisions with regard to environmental consequences—oil companies that drill in deep water, for instance—make higher-than-average profits, earning the confidence of the market that enables them to borrow, invest, expand, and pay their upper management well. CEOs that actually practice environmental conscience do not get the market’s confidence. Environmental risk (mitigated by good quality public relations to excuse the “occasional mistakes”) represents the frontier in business success. Every time a BP-Gulf Coast-type disaster is cleaned up—greenwashed, excused, and forgotten—the risk business just keeps getting better, more knowledgeable, and smoother in its politico-cultural operations. So as BP was recovering investor confidence in the summer of 2010 the company announced that it was selling its onshore drilling operations to concentrate even more on deep-sea drilling. The risk that produces economic catastrophe also creates environmental crises.

When the contradictions of global finance capitalism moved the system into crisis, as in the Great Recession starting in 2007, the state comes to the rescue of capital, the resurrection of economic growth is the urgent priority, while the environment is the necessary sacrificial lamb. Instead, the problems that capitalism periodically encounters are said to be solvable through the market mechanisms (carbon trading) that radical critics say causes them.

The neoliberal globalization that deindustrialized the first world, and industrialized parts of the third world—Brazil, South Korea, China, and India—resulted in a spectacular globalization of environmental destruction. Globalization of this neoliberal, financial kind means that economic growth rates slow down in the “deindustrialized” center, but increase rapidly in some peripheral industrializing countries at rates of 8–10 percent a year. China’s economy grew fourteen fold between 1980 and 2006 to the equivalent of a GDP of $4.4 trillion, and India’s economy grew six fold to $1.2 trillion,18 with carbon dioxide emissions quadrupling in both countries. China’s carbon dioxide emissions from burning fossil fuels amounted to 407 million tons of carbon in 1980 and 1,665 million tons in 2006; India’s went from 95 million tons in 1980 to 411 million tons.19 Much of this production and pollution is connected to consumption in the first world—40 percent of China’s product is exported, and 20 percent of India’s, while both economies have become dramatically more export-oriented. So we have seen the globalization of an economy, still centered on serving consumption in the high-income countries. This has led to an intensification of the globalization of pollution, as evidenced from carbon dioxide emissions. In 2006 global fossil-fuel carbon emissions amounted to 8,230 million metric tons of carbon. In global terms, more than 500 billion tons of carbon have been released to the atmosphere from the burning of fossil fuels and cement production since 1750, and half of these emissions have happened since the mid-1970s when it was already known that greenhouse gasses caused global warming.20 The point is that environmental pollution is driven by economic necessity under capitalism. It is necessary to pollute so that money can be made. Within the existing political-economic context, drastically decreasing pollution can only be brought about by economic recession. Thus, between 2008 and 2009 there was a temporary decline of 5.9 percent in global carbon dioxide emissions from burning fossil fuels. This was brought about by a decline of 2.5 percent in global GDP, a decline of 11.5 percent in the manufacturing production index, and a reduction of 40 percent in raw steel production.21 Yet it is politically impossible for parties or governments to suggest, in effect, that the necessary price of ending environmental destruction is a declining economy. The “solution” is to displace discussion “upwards” from the national scale to the international. Upward displacement in the environmental discourse necessarily takes the form of UN conferences, “Earth summits,” and non-enforceable Protocols. Economic necessity produces endless political evasion on the environment.22

And yet, under neoliberalism we find state regulation of development, and its relations with the environment, diminishing in significance due to the intensification of neoliberal beliefs about government, markets, and policies. This includes mass beliefs. Hence the Tea Party movement is founded on the idea of a smaller, less interventionary government at a time when state intervention in the form of environmental regulation is all we have in the way of collective response to the destruction of nature. Marxists have sometimes spoken of “false consciousness,” but this is more a case of “inverted consciousness”—the opposite of what should be the popular mentality. Or maybe “perverse consciousness”? Perverted that is.

Silly in the Face of Catastrophe

And yet the present crises in the economy and the state could be lessened (for real, long-term solutions of course even more drastic changes would be needed) by taking money and power away from the financial elite. This could be done right now. Incomes could be redistributed through the taxation system—the state could tax the rich, subsidize social services for the poor, and pay off the deficit. As the financial crisis of the last few years has shown, a lot less money going to the super rich would dampen their speculative excess and stabilize the economy. More money coursing through the social economy, through the media of education and health care, would produce a saner, steadier, and more controllable system. What is ethical can also be good for the economy. Yet in the latest act of this awful dilemma, reacting to the recession caused by finance capital’s reckless speculation, the neoliberal state is imposing sanctions—not on the speculators, but on the hardworking people whose taxes bailed out the financial system! Austerity is punishment for the crimes of the wealthy, but is imposed on everyone but the culprits.

At the present time even practical arguments like this, however, are considered out of bounds as viable political solutions by “responsible spokespersons.” As societies decline, silliness rises. This is not an accident of history. When you cannot mention, let alone debate, sensible solutions to societal problems, then the politics of distraction is all that is left. Fiddling While Rome Burns becomes Motorcycling While America Disintegrates. Sarah Palin is a structural necessity. Politics becomes a game of appearances and deceptions (for example, the Romney candidacy). Resolving finance capitalism’s dilemmas would require state redirection of income distribution, investment, and economic development. This would mean at least a new and stronger version of democratic socialism. Otherwise known by the S word.

Notes

- ↩ Rudolf Hilferding, Finance Capital (London: Routledge & Kegan Paul, 1981).

- ↩ David Harvey, A Brief History of Neoliberalism (Oxford: University Press, 2005), 31–38.

- ↩ Randy Martin, Financialization of Daily Life (Philadelphia: Temple University Press, 2002).

- ↩ John Bellamy Foster and Hannah Holleman, “The Financial Power Elite,” Monthly Review 62, no. 1 (2010): 2.

- ↩ Richard Peet, Geography of Power (London: Zed Books, 2007).

- ↩ Robert Pollin, Contours of Descent (London: Verso, 2003), 133.

- ↩ World Bank. World Development Report (New York: Oxford University Press, 2010).

- ↩ United Nations Development Program, Annual Report 2007 (New York: United Nations Development Program, 2007).

- ↩ Richard C. Leone, foreword to Edward N. Wolff, Top Heavy (New York: The New Press, 1996).

- ↩ Wolff, Top Heavy.

- ↩ Thomas Piketty and Emanuel Saez, “Income Inequality in the United States, 1913–1998,” The Quarterly Journal of Economics 118, no. 1 (2003): 1–39; “Tables and Figures Updated to 2008,” July 2010, http://econ.berkeley.edu/~saez.

- ↩ Thomas Piketty and Emmanuel Saez, “The Evolution of Top Incomes: A Historical and International Perspective,” American Economic Review, Papers and Proceedings, 96, no. 2 (2006): 200–205.

- ↩ Jens Alber and Neils Gilbert, eds., United in Diversity? (New York: Oxford University Press, 2010).

- ↩ US Bureau of Labor Statistics, “Union Members Summary,” July 21, 2011, http://bls.gov.

- ↩ Thomas G. Moehrle, “The Evolution of Compensation in a Changing Economy,” January 30, 2003, http://bls.gov.

- ↩ Alan Walks, “Bailing out the Wealthy: Responses to the Financial Crisis, Ponzi Neoliberalism and the City,” Human Geography 3, no. 3 (2010): 54–84.

- ↩ Richard Peet, “Ten Pages that Changed the World: Deconstructing Ricardo,” Human Geography 2, no. 1 (2009): 81–95.

- ↩ International Monetary Fund, World Economic Outlook 2009 (2009), http://imf.org.

- ↩ Carbon Dioxide Information Analysis Center, “Fossil-Fuel CO2 Emissions,” http://cdiac.ornl.gov.

- ↩ Stephen H. Schneider, The Genesis Strategy (New York: Plenum, 1976); Heidi Cullen, The Weather of the Future (New York: Harper, 2011), 270.

- ↩ US Energy Information Administration, “Short-Term Energy Outlook Supplement: Understanding the Decline in Carbon Dioxide Emissions in 2009,” October 2009, http://eia.doe.gov.

- ↩ Richard Peet, Paul Robbins, and Michael Watts, eds., Global Political Ecology (London: Routledge, 2011).

Sem comentários:

Enviar um comentário